Government Initiatives and Support

Government initiatives aimed at improving healthcare infrastructure are significantly influencing the Italy pharmacy management system market. The Italian government has introduced various policies to promote digital health solutions, which include funding for pharmacies to upgrade their management systems. In 2025, the government allocated approximately 200 million euros to support the digital transformation of healthcare services, including pharmacy management. This financial backing is expected to enhance the capabilities of pharmacies, making them more efficient and responsive to patient needs. Consequently, the Italy pharmacy management system market is poised for growth as pharmacies leverage these initiatives to modernize their operations.

Increased Emphasis on Data Analytics

The increased emphasis on data analytics is shaping the Italy pharmacy management system market. Pharmacies are increasingly recognizing the value of data in making informed business decisions and improving patient outcomes. In 2025, approximately 70% of pharmacies in Italy reported using data analytics tools to track sales trends and patient preferences. This analytical approach allows pharmacies to tailor their services and inventory to meet the specific needs of their communities. As the demand for data-driven decision-making grows, the Italy pharmacy management system market is likely to expand, with more pharmacies adopting advanced analytics capabilities.

Integration of Advanced Technologies

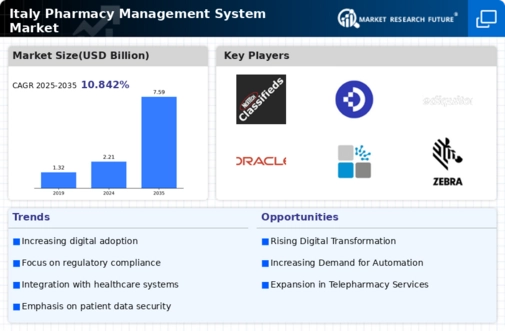

The integration of advanced technologies such as artificial intelligence and machine learning is driving the Italy pharmacy management system market. These technologies enhance operational efficiency by automating routine tasks, thereby reducing human error. In 2025, it was reported that over 60% of pharmacies in Italy adopted some form of automation, indicating a strong trend towards technological integration. This shift not only streamlines inventory management but also improves patient care through better data analysis. As pharmacies increasingly rely on these technologies, the Italy pharmacy management system market is likely to witness substantial growth, with projections suggesting a compound annual growth rate of 8% over the next five years.

Rising Demand for Telepharmacy Services

The rising demand for telepharmacy services is emerging as a key driver in the Italy pharmacy management system market. As patients increasingly seek remote healthcare solutions, pharmacies are adapting their management systems to facilitate telehealth consultations and prescription services. In 2025, it was estimated that telepharmacy services accounted for nearly 15% of total pharmacy transactions in Italy. This trend is likely to continue, as patients appreciate the convenience and accessibility of remote services. Consequently, the Italy pharmacy management system market must evolve to support these services, ensuring that pharmacies can effectively manage both in-person and virtual interactions.

Focus on Inventory Management Optimization

The focus on optimizing inventory management is a critical driver in the Italy pharmacy management system market. Effective inventory management is essential for pharmacies to minimize waste and ensure the availability of essential medications. In 2025, it was reported that pharmacies utilizing advanced management systems reduced their inventory costs by up to 20%. This optimization not only enhances profitability but also improves patient satisfaction by ensuring that medications are readily available. As pharmacies continue to prioritize inventory efficiency, the Italy pharmacy management system market is expected to grow, with more pharmacies investing in sophisticated management solutions.