Rising Healthcare Expenditure

India's healthcare expenditure has been on an upward trajectory, which is positively influencing the osteosynthesis implants market. The government and private sectors are increasingly investing in healthcare infrastructure, leading to improved access to advanced medical technologies. In recent years, healthcare spending has risen to approximately 3.5% of GDP, reflecting a commitment to enhancing medical services. This increase in expenditure allows for the procurement of high-quality osteosynthesis implants, which are essential for effective surgical outcomes. Furthermore, as more hospitals adopt advanced surgical techniques, the demand for innovative implants is likely to grow. The osteosynthesis implants market stands to benefit from this trend, as healthcare providers prioritize patient outcomes and invest in state-of-the-art solutions to address orthopedic challenges.

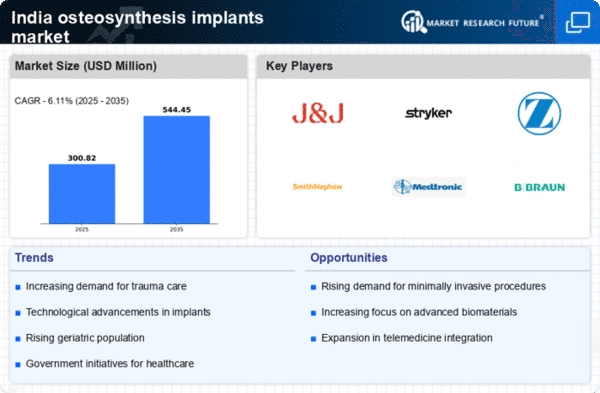

Increasing Geriatric Population

The shift towards an aging population in India is a crucial driver for the osteosynthesis implants market. As individuals age, the prevalence of orthopedic conditions such as fractures and degenerative diseases rises significantly. According to recent statistics, the geriatric population in India is projected to reach approximately 300 million by 2050, which indicates a growing demand for surgical interventions. This demographic trend necessitates the use of osteosynthesis implants to facilitate recovery and improve quality of life. The increasing number of elderly patients undergoing orthopedic surgeries is likely to propel the market forward. Healthcare providers are seeking effective solutions to address age-related musculoskeletal issues. Consequently, the osteosynthesis implants market is expected to expand in response to this demographic challenge, with healthcare systems adapting to meet the needs of an older population.

Government Initiatives and Policies

Government initiatives aimed at improving healthcare access and affordability are playing a pivotal role in shaping the osteosynthesis implants market. Policies that promote the use of advanced medical technologies and subsidize healthcare costs are encouraging hospitals to invest in high-quality implants. The introduction of schemes such as Ayushman Bharat aims to provide financial protection to low-income families, thereby increasing access to necessary surgical interventions. As more patients gain access to orthopedic care, the demand for osteosynthesis implants is likely to rise. Additionally, regulatory support for the approval of innovative implant technologies is expected to foster market growth. The osteosynthesis implants market is thus benefiting from a conducive policy environment that prioritizes patient care and technological advancement.

Growing Awareness of Orthopedic Health

There is a notable increase in public awareness regarding orthopedic health in India, which serves as a significant driver for the osteosynthesis implants market. Educational campaigns and health initiatives have contributed to a better understanding of the importance of timely intervention for orthopedic conditions. As individuals become more informed about the risks associated with untreated fractures and joint issues, they are more likely to seek medical attention. This shift in awareness is reflected in the rising number of orthopedic consultations and surgeries. Consequently, the demand for osteosynthesis implants is expected to rise as patients opt for surgical solutions to address their orthopedic concerns. The osteosynthesis implants market is likely to thrive as healthcare providers respond to this growing awareness by offering advanced treatment options.

Technological Innovations in Implant Design

Technological innovations in the design and manufacturing of osteosynthesis implants are transforming the market landscape in India. Advances in materials science and engineering have led to the development of implants that are not only stronger but also more biocompatible. These innovations enhance the effectiveness of surgical procedures and improve patient outcomes. For instance, the introduction of bioresorbable implants is gaining traction, as they eliminate the need for subsequent surgeries to remove hardware. The osteosynthesis implants market is poised for growth as these cutting-edge technologies become more widely adopted in surgical practices. Furthermore, the integration of 3D printing technology in implant production allows for customized solutions tailored to individual patient needs, further driving market expansion.