Rising Focus on Data Security and Integrity

In the Italy laboratory information management systems market, the emphasis on data security and integrity is becoming increasingly paramount. With the growing volume of sensitive data generated in laboratories, there is a pressing need for robust systems that ensure data protection. Recent statistics indicate that over 70% of Italian laboratories prioritize data security in their operational strategies. This focus is largely driven by stringent regulations and the potential risks associated with data breaches. Consequently, laboratory information management systems that offer advanced security features, such as encryption and access controls, are in high demand. As laboratories seek to safeguard their data while maintaining compliance, the Italy laboratory information management systems market is likely to witness a surge in the adoption of secure LIMS solutions.

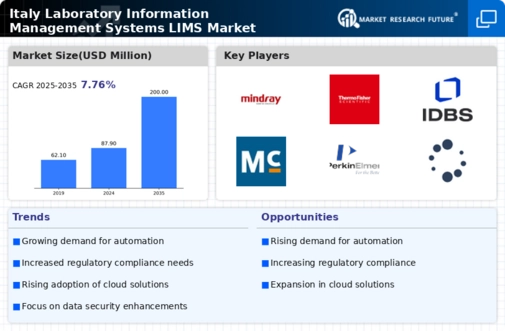

Growing Demand for Automation in Laboratories

The Italy laboratory information management systems market is experiencing a notable shift towards automation. Laboratories are increasingly seeking to enhance efficiency and reduce human error through automated processes. This trend is driven by the need for faster turnaround times and improved data accuracy. According to recent data, approximately 60% of laboratories in Italy are investing in automation technologies, which is expected to boost the demand for laboratory information management systems. Automation not only streamlines workflows but also facilitates better compliance with regulatory standards, thereby enhancing the overall quality of laboratory operations. As laboratories strive to optimize their processes, the integration of LIMS solutions becomes essential, positioning the Italy laboratory information management systems market for substantial growth.

Emphasis on Personalized Medicine and Genomics

The Italy laboratory information management systems market is increasingly shaped by the emphasis on personalized medicine and genomics. As the healthcare sector shifts towards tailored treatment approaches, laboratories are required to manage complex genomic data effectively. This trend is reflected in the growing number of genetic testing laboratories in Italy, which are projected to increase by 20% over the next five years. Laboratory information management systems that can handle large datasets and integrate with genomic analysis tools are becoming essential. This demand for LIMS solutions is driven by the need for accurate data management and analysis in personalized medicine initiatives. As the focus on genomics continues to rise, the Italy laboratory information management systems market is likely to experience significant growth, with LIMS playing a crucial role in supporting these advancements.

Expansion of Biobanking and Research Initiatives

The Italy laboratory information management systems market is significantly influenced by the expansion of biobanking and research initiatives. As Italy continues to invest in biomedical research, the need for efficient data management systems becomes critical. Biobanks require sophisticated laboratory information management systems to handle vast amounts of biological data and samples. Recent reports suggest that the biobanking sector in Italy is projected to grow by 15% annually, thereby driving the demand for LIMS solutions tailored to biobanking needs. These systems facilitate sample tracking, data analysis, and regulatory compliance, which are essential for successful research outcomes. As the biobanking landscape evolves, the Italy laboratory information management systems market is poised for growth, with LIMS playing a pivotal role in supporting research endeavors.

Increased Investment in Healthcare Infrastructure

The Italy laboratory information management systems market is benefiting from increased investment in healthcare infrastructure. The Italian government has been allocating substantial funds to modernize healthcare facilities, which includes upgrading laboratory systems. This investment is aimed at improving healthcare delivery and ensuring that laboratories are equipped with the latest technologies. Recent data indicates that healthcare spending in Italy is expected to rise by 5% annually, with a significant portion directed towards laboratory enhancements. As laboratories upgrade their infrastructure, the demand for advanced laboratory information management systems is likely to increase. These systems not only improve operational efficiency but also enhance patient care by providing timely and accurate test results, thereby positioning the Italy laboratory information management systems market for robust growth.