Aging Population

Italy's demographic landscape is characterized by an aging population, which seems to be a crucial factor influencing the dental services market. As the proportion of elderly individuals increases, there is a corresponding rise in the demand for dental services tailored to age-related issues, such as tooth loss and periodontal disease. The elderly population is projected to reach 25% of the total population by 2030, indicating a substantial market opportunity for dental practitioners. This demographic shift may lead to an expansion of specialized services, thereby enhancing the overall growth of the dental services market in Italy.

Rising Oral Health Awareness

The increasing awareness of oral health among the Italian population appears to be a significant driver for the dental services market. Educational campaigns and public health initiatives have contributed to a heightened understanding of the importance of dental hygiene. As a result, more individuals are seeking regular dental check-ups and preventive care, which is likely to boost demand for various dental services. According to recent data, approximately 70% of Italians now visit a dentist at least once a year, reflecting a shift towards proactive dental care. This trend is expected to continue, potentially leading to a growth in the dental services market as consumers prioritize their oral health.

Economic Growth and Disposable Income

The economic recovery in Italy appears to be positively impacting the dental services market. As disposable incomes rise, individuals are more likely to invest in their oral health, including elective procedures and cosmetic dentistry. Recent statistics indicate that the average household income has increased by approximately 5% over the past year, allowing more people to afford dental care. This trend suggests that as economic conditions improve, the demand for a wider range of dental services will likely increase, further stimulating growth in the market.

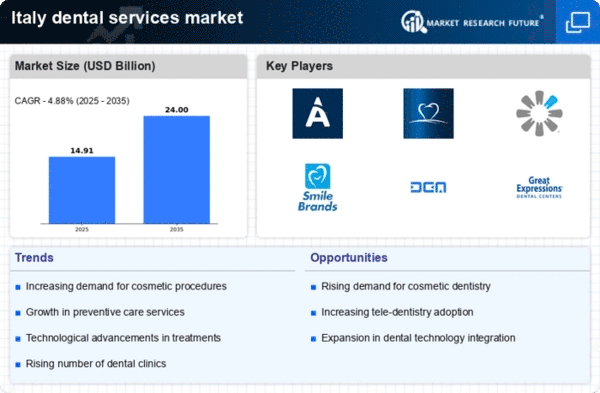

Increased Focus on Aesthetic Dentistry

The growing emphasis on aesthetic dentistry is emerging as a notable driver for the dental services market. As societal standards evolve, more individuals are seeking cosmetic procedures to enhance their smiles, including teeth whitening, veneers, and orthodontics. Recent surveys suggest that nearly 30% of Italians express interest in cosmetic dental treatments, reflecting a cultural shift towards prioritizing appearance. This increasing demand for aesthetic services is likely to propel the dental services market forward, as practitioners expand their offerings to meet consumer preferences.

Technological Advancements in Dentistry

Technological advancements in dental care are playing a pivotal role in shaping the dental services market. Innovations such as digital imaging, laser dentistry, and tele-dentistry are enhancing the efficiency and effectiveness of dental treatments. These technologies not only improve patient outcomes but also streamline practice operations, making dental services more accessible. In Italy, the adoption of such technologies is on the rise, with approximately 40% of dental practices integrating advanced tools into their services. This trend indicates a potential for growth in the dental services market as practices seek to attract tech-savvy patients.