Aging Population

The aging population is a crucial driver of the Dental Services Market. As individuals age, they often experience a higher prevalence of dental issues, including periodontal disease and tooth decay. This demographic shift is expected to increase the demand for dental services significantly. According to recent data, the population aged 65 and older is projected to reach over 1.5 billion by 2050, which suggests a growing need for dental care tailored to older adults. This trend may lead to an expansion of specialized dental services, including geriatric dentistry, thereby enhancing the overall landscape of the Dental Services Market.

Rising Disposable Income

Rising disposable income levels are contributing to the growth of the Dental Services Market. As individuals experience an increase in their financial resources, they are more likely to invest in their oral health. This trend is particularly evident in emerging economies, where a burgeoning middle class is prioritizing dental care as part of their overall health and wellness. Data suggests that spending on dental services is expected to rise in tandem with income growth, leading to an increase in demand for both routine and elective dental procedures. Consequently, this economic shift is likely to enhance the overall dynamics of the Dental Services Market.

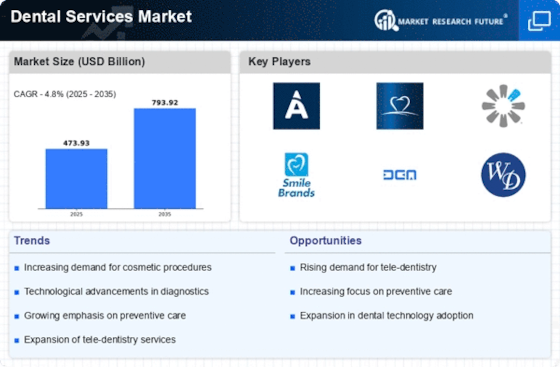

Technological Advancements

Technological advancements are transforming the Dental Services Market, driving growth and enhancing patient care. Innovations such as digital imaging, 3D printing, and tele-dentistry are revolutionizing how dental services are delivered. For instance, the adoption of CAD/CAM technology allows for more precise and efficient dental restorations, which can improve patient outcomes. Furthermore, the integration of electronic health records (EHR) facilitates better patient management and communication among dental professionals. As these technologies become more accessible, they are likely to attract more patients seeking modern and efficient dental care, thus propelling the Dental Services Market forward.

Increased Awareness of Oral Health

There is a growing awareness of the importance of oral health, which serves as a significant driver for the Dental Services Market. Educational campaigns and public health initiatives have highlighted the link between oral health and overall well-being. This heightened awareness has led to an increase in preventive dental care visits, as individuals recognize the value of maintaining good oral hygiene. Data indicates that preventive services account for a substantial portion of dental visits, with many patients seeking regular check-ups and cleanings. Consequently, this trend is likely to bolster the demand for various dental services, thereby positively impacting the Dental Services Market.

Expansion of Dental Insurance Coverage

The expansion of dental insurance coverage is a pivotal driver of the Dental Services Market. As more individuals gain access to dental insurance, the affordability of dental care improves, leading to increased utilization of services. Recent statistics indicate that approximately 60% of the population now has some form of dental insurance, which encourages regular dental visits and preventive care. This trend is likely to continue as policymakers and insurance providers recognize the importance of oral health in overall health outcomes. As a result, the expansion of coverage is expected to stimulate growth in the Dental Services Market, making dental care more accessible to a broader population.