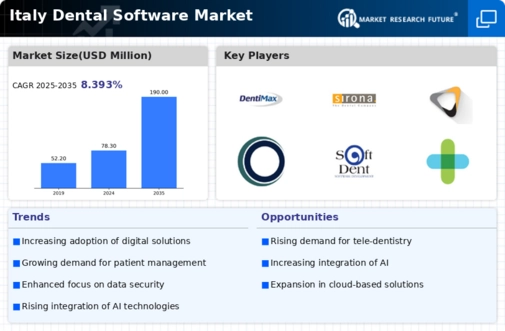

The Italy Dental Software Market is seeing important developments driven by the adoption of digital solutions in dental practices across the country. The implementation of modern technologies like AI, cloud, and telemedicine are transforming service delivery so that more professionals can provide better patient care, enhance practice productivity, and optimize workflows.

There is an increasing demand in the innovative IT healthcare industry for remote patient consultation and software-based management systems, responding to demand shifts from dentists and patients. The need to enhance operational efficiency is emerging to provide adequate solutions for managing clinical practices, which is one of the most pronounced trends in the market.

There are new developments in practice management software for streamlined scheduling, patient record access, and billing that need to be adopted by Italian dentists. This is in line with the governmental policy for the digitalization of healthcare services which aims at establishing integrated digital systems to enhance service delivery within the healthcare system.

There is a gap in the market for tailoring software orthopedic workflows and for addressing the specific needs of the Italian dental practices. Businesses can take advantage of the competitive environment of untailored regulatory standards and the absence of non-discriminatory regulatory policies at the local level.

There has been a noticeable uptick in the number of training programs and workshops aimed at dental professionals, which strive toward improving the understanding and application of these digital tools with the intention of increasing software adoption even further. Overall, the Italy Dental Software Market is adapting while trying to foster new innovations because of the government's encouragement towards advancements in healthcare, as well as the willingness of the dental community to change. The observations suggest strong prospects as practices prepare to face contemporary challenges using technological solutions already embedded within practices.