North America : Market Leader in IT Services

North America continues to lead the IT Operations Maintenance Services market, holding a significant share of 30.25% as of December 2025. The region's growth is driven by rapid technological advancements, increasing demand for cloud services, and stringent regulatory frameworks that promote IT security and efficiency. Companies are investing heavily in automation and AI to enhance service delivery, which is further supported by government initiatives aimed at digital transformation.

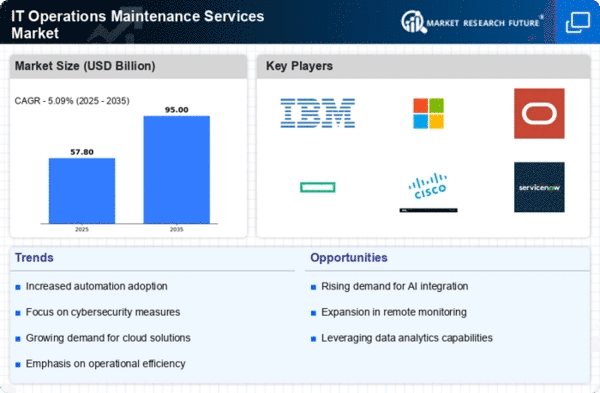

The competitive landscape is robust, with key players like IBM, Microsoft, and Oracle dominating the market. The U.S. remains the largest contributor, benefiting from a strong infrastructure and a skilled workforce. Additionally, the presence of major tech firms fosters innovation and collaboration, ensuring that North America remains at the forefront of IT operations maintenance services.

Europe : Emerging IT Services Hub

Europe's IT Operations Maintenance Services market is poised for growth, currently valued at €15.0 billion. The region is experiencing increased demand for IT services driven by digital transformation initiatives and regulatory compliance requirements. The European Union's focus on cybersecurity and data protection is catalyzing investments in IT maintenance services, ensuring that organizations meet stringent standards while optimizing operational efficiency.

Leading countries such as Germany, France, and the UK are at the forefront of this growth, with a competitive landscape featuring major players like Atos and Capgemini. The presence of these firms, along with a strong emphasis on innovation and sustainability, positions Europe as a key player in The IT Operations Maintenance Services. The region's commitment to fostering a digital economy is evident in its strategic investments and partnerships.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region is witnessing a significant expansion in the IT Operations Maintenance Services market, currently valued at $8.5 billion. This growth is fueled by increasing digitalization across various sectors, rising investments in IT infrastructure, and a growing emphasis on cloud computing. Governments in countries like India and China are implementing policies to enhance digital capabilities, which is driving demand for IT maintenance services to support these initiatives.

Key players such as Tata Consultancy Services and Accenture are capitalizing on this growth, establishing a strong presence in the region. The competitive landscape is characterized by a mix of local and international firms, all vying for market share. As businesses increasingly adopt advanced technologies, the demand for efficient IT operations maintenance services is expected to rise, further solidifying the region's position in the global market.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is gradually emerging as a potential market for IT Operations Maintenance Services, currently valued at $1.25 billion. The growth is driven by increasing investments in technology infrastructure and a rising awareness of the importance of IT maintenance for operational efficiency. Governments are prioritizing digital transformation initiatives, which are expected to create significant demand for IT services in the coming years.

Countries like South Africa and the UAE are leading the charge, with a growing number of local and international players entering the market. The competitive landscape is evolving, with firms focusing on tailored solutions to meet the unique needs of businesses in the region. As the market matures, opportunities for growth in IT operations maintenance services are expected to expand, supported by favorable regulatory environments and strategic partnerships.