Increased Use in Agrochemicals

The Isobutyric Acid Market is likely to benefit from the rising utilization of isobutyric acid in agrochemical formulations. This compound serves as a precursor for various herbicides and pesticides, which are essential for modern agriculture. With the global population projected to reach 9.7 billion by 2050, the demand for agricultural productivity is expected to surge. Consequently, agrochemical companies are increasingly focusing on developing effective solutions to enhance crop yields. The agrochemicals market has shown a steady growth trajectory, indicating a potential increase in the consumption of isobutyric acid. This trend suggests that the Isobutyric Acid Market may see a significant uptick in demand as agricultural practices evolve to meet the needs of a growing population.

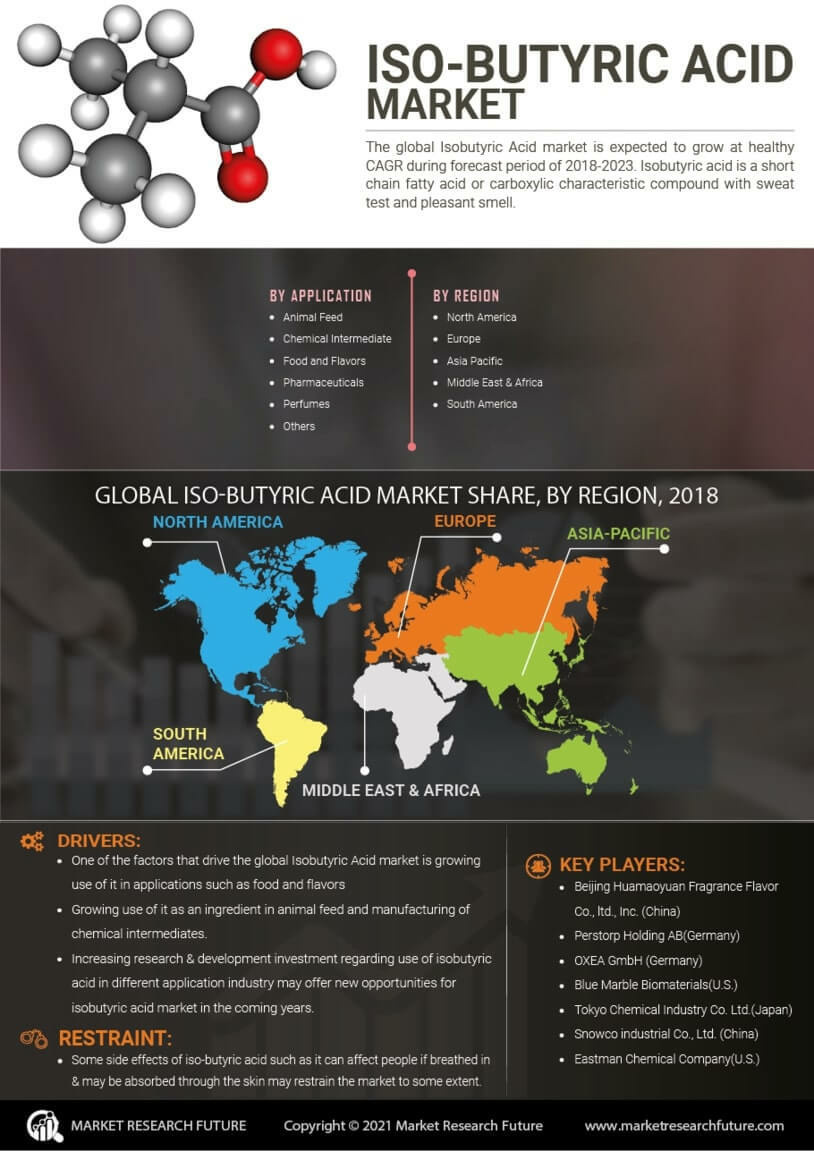

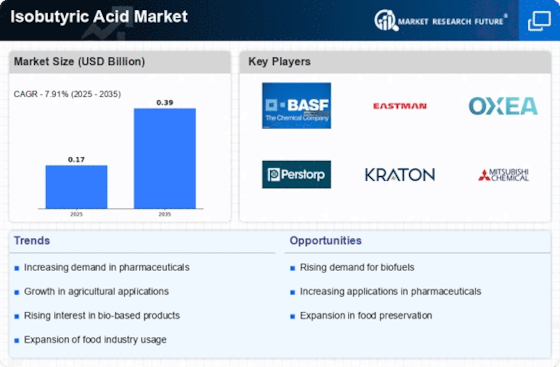

Rising Demand in Chemical Synthesis

The Isobutyric Acid Market is poised for growth due to its critical role in chemical synthesis. Isobutyric acid is a vital building block for the production of various chemicals, including esters, which are widely used in the manufacturing of plastics, solvents, and coatings. The chemical industry has been expanding, driven by the increasing need for innovative materials and products. Market data indicates that The Isobutyric Acid Market is expected to grow at a compound annual growth rate (CAGR) of over 5% in the coming years. This growth could lead to a heightened demand for isobutyric acid as manufacturers seek to optimize their production processes and develop new applications. Thus, the Isobutyric Acid Market may experience a favorable environment for expansion.

Growing Applications in Food Industry

The Isobutyric Acid Market is experiencing a notable increase in demand due to its diverse applications in the food sector. This compound is utilized as a flavoring agent and preservative, enhancing the taste and shelf life of various food products. The food industry has seen a shift towards natural and organic ingredients, which aligns with the properties of isobutyric acid. As consumers become more health-conscious, the need for safe and effective food additives is paramount. Reports indicate that the food additives market is projected to grow significantly, which could further bolster the demand for isobutyric acid as a key ingredient. This trend suggests that the Isobutyric Acid Market may continue to expand as food manufacturers seek to innovate and meet consumer preferences.

Technological Advancements in Production

The Isobutyric Acid Market is likely to benefit from ongoing technological advancements in production methods. Innovations in chemical processes and biotechnological approaches are enhancing the efficiency and sustainability of isobutyric acid production. These advancements not only reduce production costs but also minimize environmental impact, aligning with the increasing emphasis on sustainable practices across industries. As manufacturers adopt more efficient production techniques, the availability of isobutyric acid is expected to rise, potentially leading to lower prices and increased accessibility. This trend suggests that the Isobutyric Acid Market may see a boost in demand as companies strive to meet both economic and environmental goals.

Expanding Applications in Personal Care Products

The Isobutyric Acid Market is witnessing a growing interest in its applications within the personal care sector. Isobutyric acid is utilized in the formulation of various cosmetic and personal care products, including skin creams, hair care items, and fragrances. As consumers increasingly prioritize personal care and grooming, the demand for effective and safe ingredients is on the rise. Market analysis indicates that the personal care market is projected to grow significantly, driven by changing consumer preferences and an increasing focus on self-care. This trend suggests that the Isobutyric Acid Market may experience heightened demand as manufacturers seek to incorporate isobutyric acid into their product lines to meet evolving consumer needs.