North America : Market Leader in Innovation

North America is poised to maintain its leadership in the irrigation system installation services market, holding a significant share of 4.5 in 2024. The region's growth is driven by increasing agricultural efficiency demands, technological advancements, and supportive government policies promoting sustainable practices. The rising focus on water conservation and precision agriculture is further propelling market expansion.

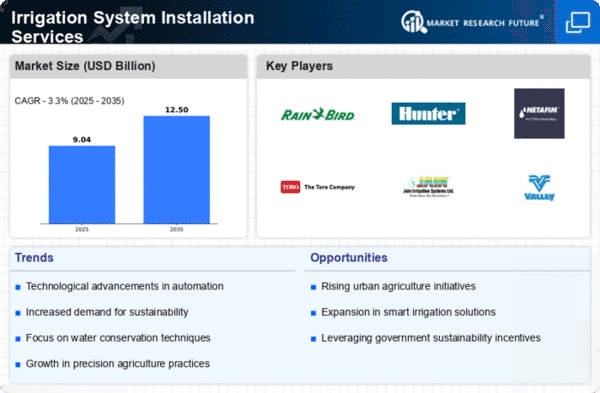

The competitive landscape is characterized by key players such as Rain Bird Corporation, Hunter Industries, and Toro Company, which are at the forefront of innovation. The U.S. remains the leading country, supported by a robust infrastructure and investment in modern irrigation technologies. This competitive environment fosters continuous improvement and adaptation to market needs, ensuring North America's dominance in the sector.

Europe : Sustainable Practices on the Rise

Europe's irrigation system installation services market is valued at 2.5, reflecting a growing emphasis on sustainable agricultural practices. The region is witnessing increased demand for efficient irrigation solutions driven by climate change and water scarcity concerns. Regulatory frameworks, such as the EU Water Framework Directive, are catalyzing investments in modern irrigation technologies, enhancing market growth.

Leading countries like Germany, France, and Italy are at the forefront of this transformation, with a competitive landscape featuring key players such as Netafim and Irritec. The focus on sustainability and innovation is reshaping the market, encouraging collaboration among stakeholders to develop advanced irrigation solutions. This strategic approach positions Europe as a significant player in The Irrigation System Installation Services.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region, with a market size of 1.75, is emerging as a significant player in the irrigation system installation services sector. The growth is primarily driven by increasing agricultural productivity demands, population growth, and government initiatives aimed at enhancing food security. Countries are investing in modern irrigation technologies to address water scarcity and improve crop yields, creating a favorable market environment.

Key players like Jain Irrigation Systems and Valley Irrigation are expanding their presence in countries such as India and China, where the demand for efficient irrigation solutions is surging. The competitive landscape is evolving, with local and international companies vying for market share. This dynamic environment is expected to foster innovation and drive further growth in the region.

Middle East and Africa : Resource-Rich Yet Challenged

The Middle East and Africa region, with a market size of 0.5, faces unique challenges and opportunities in the irrigation system installation services market. Water scarcity and arid climates drive the demand for efficient irrigation solutions, making this sector crucial for agricultural sustainability. Governments are increasingly recognizing the importance of modern irrigation practices to enhance food security and manage water resources effectively.

Countries like South Africa and the UAE are leading the way in adopting advanced irrigation technologies, supported by key players such as Lindsay Corporation. The competitive landscape is characterized by a mix of local and international firms, all striving to address the pressing need for efficient water management solutions. This growing focus on irrigation services is expected to shape the future of agriculture in the region.