Innovative Drug Formulations

The Interstitial Cystitis Drugs Market is witnessing a surge in innovative drug formulations aimed at improving patient outcomes. Recent advancements in drug delivery systems, such as sustained-release formulations and combination therapies, are enhancing the efficacy of existing treatments. For instance, the introduction of intravesical therapies has shown promise in delivering medications directly to the bladder, potentially reducing systemic side effects. Additionally, the market is seeing the emergence of biologics and novel compounds that target specific pathways involved in IC. These innovations not only provide new therapeutic options but also stimulate competition among pharmaceutical companies, which may lead to more affordable pricing and increased accessibility for patients.

Regulatory Support for Drug Approvals

Regulatory support for the approval of new drugs is a significant factor influencing the Interstitial Cystitis Drugs Market. Regulatory agencies are increasingly recognizing the need for expedited pathways for drugs targeting rare and chronic conditions like IC. Initiatives such as orphan drug designations and fast-track approvals are encouraging pharmaceutical companies to invest in the development of new therapies. This supportive regulatory environment not only accelerates the time to market for innovative treatments but also enhances the overall attractiveness of the IC drug market for investors and developers. As a result, the influx of new products is expected to invigorate competition and improve treatment options for patients.

Rising Demand for Patient-Centric Solutions

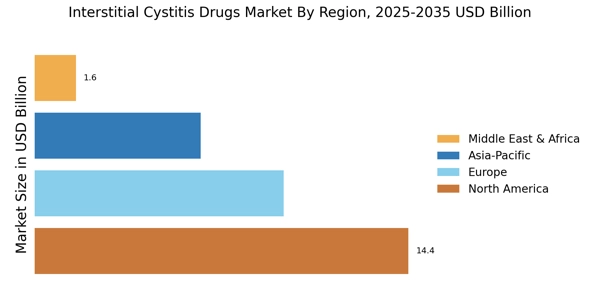

The shift towards patient-centric healthcare solutions is driving the Interstitial Cystitis Drugs Market. Patients are increasingly seeking treatments that not only alleviate symptoms but also improve their quality of life. This demand is prompting pharmaceutical companies to focus on developing drugs that address the multifaceted nature of IC, including pain management and psychological support. Additionally, the integration of digital health technologies, such as mobile applications for symptom tracking and telehealth consultations, is enhancing patient engagement in their treatment plans. As the market evolves to meet these patient needs, it is likely to see a rise in the development of comprehensive treatment strategies that encompass both pharmacological and non-pharmacological approaches.

Growing Investment in Research and Development

Investment in research and development (R&D) for interstitial cystitis treatments is a critical driver for the Interstitial Cystitis Drugs Market. Pharmaceutical companies are increasingly allocating resources to explore new therapeutic avenues, including the investigation of underlying mechanisms of IC and the development of targeted therapies. According to industry reports, R&D spending in the urology sector has seen a steady increase, with a focus on understanding the pathophysiology of IC. This commitment to innovation is likely to yield new drug candidates that can address unmet medical needs, thereby expanding the market and providing patients with more effective treatment options.

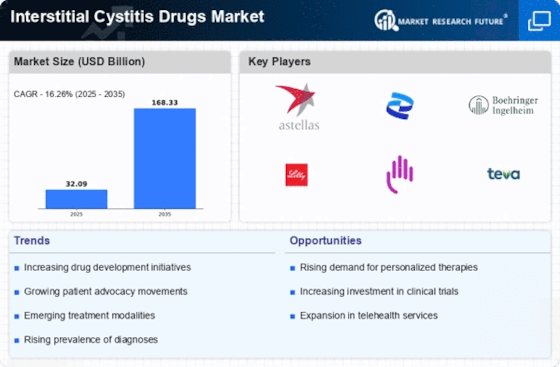

Increasing Prevalence of Interstitial Cystitis

The rising prevalence of interstitial cystitis (IC) is a notable driver for the Interstitial Cystitis Drugs Market. Recent estimates suggest that IC affects approximately 3 to 8 million individuals in the United States alone, with a significant number of cases remaining undiagnosed. This growing patient population necessitates the development and availability of effective pharmacological treatments. As awareness of IC increases among healthcare professionals and patients, the demand for specialized drugs is likely to rise. Furthermore, the increasing recognition of IC as a chronic condition rather than a temporary ailment may lead to more patients seeking long-term management options, thereby propelling the market forward.