Rising Demand for Coordinated Care

The Integrated Delivery Network Market is experiencing a notable increase in demand for coordinated care solutions. As healthcare systems evolve, patients increasingly seek seamless transitions between various care settings. This trend is driven by the need for improved patient outcomes and satisfaction. According to recent data, approximately 70% of patients prefer integrated care models that facilitate communication among providers. This shift towards coordinated care is prompting healthcare organizations to adopt integrated delivery networks, which can enhance efficiency and reduce costs. The emphasis on patient-centered care is likely to further propel the growth of the Integrated Delivery Network Market, as stakeholders recognize the benefits of holistic approaches to health management.

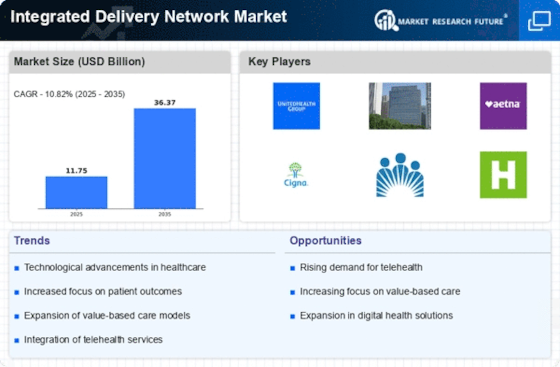

Shift Towards Value-Based Payment Models

The transition from fee-for-service to value-based payment models is significantly influencing the Integrated Delivery Network Market. This shift encourages healthcare providers to focus on patient outcomes rather than the volume of services rendered. As a result, integrated delivery networks are becoming essential in aligning incentives among various stakeholders. Recent statistics indicate that nearly 50% of healthcare payments are now tied to value-based arrangements, reflecting a growing recognition of the importance of quality care. This trend is likely to drive the adoption of integrated delivery networks, as they are well-positioned to deliver coordinated, high-quality care that meets the requirements of value-based payment systems. Consequently, the Integrated Delivery Network Market is poised for growth as organizations adapt to these evolving payment structures.

Technological Advancements in Healthcare

Technological advancements are playing a pivotal role in shaping the Integrated Delivery Network Market. Innovations such as telemedicine, electronic health records, and data analytics are enhancing the capabilities of integrated delivery networks. These technologies enable providers to share information seamlessly, improving care coordination and patient engagement. For instance, the implementation of telehealth services has surged, with a reported increase of over 30% in usage among healthcare providers. This technological integration not only streamlines operations but also supports the delivery of value-based care, which is becoming increasingly important in the healthcare landscape. As technology continues to evolve, the Integrated Delivery Network Market is expected to expand, driven by the need for efficient and effective healthcare solutions.

Regulatory Support for Integrated Care Models

Regulatory support for integrated care models is emerging as a key driver in the Integrated Delivery Network Market. Governments and regulatory bodies are increasingly recognizing the benefits of integrated delivery networks in improving healthcare efficiency and outcomes. Policies that promote collaboration among providers and incentivize integrated care are being implemented, which could lead to a more favorable environment for the growth of integrated delivery networks. For instance, recent legislative changes have introduced funding opportunities for organizations that adopt integrated care models. This regulatory backing not only encourages the establishment of integrated delivery networks but also enhances their sustainability. As such, the Integrated Delivery Network Market is likely to benefit from ongoing regulatory support, fostering an environment conducive to innovation and improved patient care.

Increased Focus on Population Health Management

The Integrated Delivery Network Market is witnessing an increased focus on population health management strategies. Healthcare organizations are recognizing the importance of addressing the health needs of entire populations rather than just individual patients. This approach aims to improve health outcomes while controlling costs, making integrated delivery networks a vital component of effective population health initiatives. Data suggests that organizations implementing population health management strategies can reduce hospital readmission rates by up to 20%. As healthcare systems strive to enhance the health of communities, the demand for integrated delivery networks is likely to rise, as they facilitate the necessary collaboration among providers to address diverse health challenges. This trend underscores the potential for growth within the Integrated Delivery Network Market.