Adoption of Cloud Services

The growing adoption of cloud services is a significant driver for the US Content Delivery Network Market. As organizations migrate to cloud-based solutions, the need for efficient content delivery becomes increasingly critical. In 2025, the cloud services market is expected to reach approximately 500 billion USD, with CDNs serving as a crucial component in ensuring fast and reliable access to cloud-hosted content. This trend is prompting CDN providers to enhance their offerings, integrating with cloud platforms to deliver optimized performance. The synergy between cloud services and CDNs is likely to foster further growth within the industry.

Evolving E-Commerce Landscape

The US Content Delivery Network Market is also being shaped by the evolving e-commerce landscape. As online shopping continues to gain traction, businesses are increasingly reliant on CDNs to ensure fast and reliable delivery of content. In 2025, e-commerce sales are projected to surpass 1 trillion USD, necessitating efficient content delivery solutions to support this growth. CDNs play a vital role in enhancing website performance, reducing bounce rates, and improving customer satisfaction. Consequently, the demand for CDN services is likely to rise, as businesses seek to optimize their online presence and drive sales.

Increased Mobile Device Usage

The proliferation of mobile devices is significantly influencing the US Content Delivery Network Market. With over 80% of internet traffic now originating from mobile devices, CDNs must adapt to ensure seamless content delivery across various platforms. This shift is prompting CDN providers to optimize their services for mobile users, which includes reducing load times and improving user experience. As a result, the market is expected to expand, with estimates suggesting a compound annual growth rate of around 12% through 2025. This adaptation to mobile usage patterns is crucial for maintaining competitive advantage in the industry.

Focus on Enhanced Security Measures

The US Content Delivery Network Market is witnessing a heightened focus on enhanced security measures. As cyber threats become more sophisticated, organizations are prioritizing the protection of their digital assets. CDNs are increasingly being utilized to provide security features such as DDoS protection and secure token authentication. In 2025, the market for CDN security solutions is projected to grow significantly, driven by the need for businesses to safeguard their online presence. This emphasis on security not only protects sensitive data but also builds consumer trust, thereby contributing to the overall growth of the CDN market.

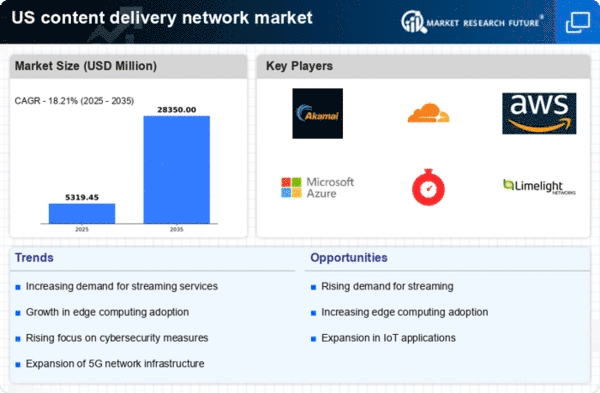

Rising Demand for High-Quality Streaming

The US Content Delivery Network Market is experiencing a notable surge in demand for high-quality streaming services. As consumers increasingly gravitate towards video-on-demand platforms, the need for efficient content delivery becomes paramount. In 2025, the market is projected to reach approximately 15 billion USD, driven by the proliferation of 4K and 8K streaming. This trend necessitates robust CDN solutions that can handle large volumes of data with minimal latency. Consequently, service providers are compelled to enhance their infrastructure to meet these expectations, thereby propelling growth within the industry.