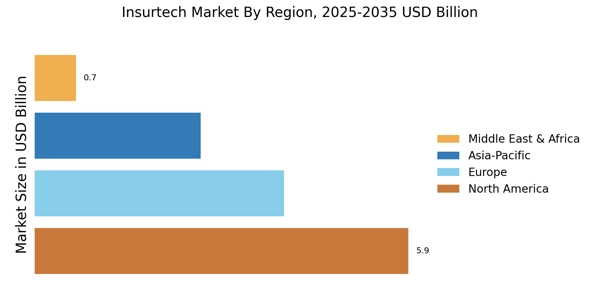

North America : Innovation and Market Leadership

North America leads the insurtech market, driven by robust startup ecosystems, regulatory adaptability, and high adoption of cloud computing in insurtech market infrastructures. North America remains the largest market for insurtech, holding approximately 45% of the global market share. The region's growth is driven by technological advancements, increasing consumer demand for digital insurance solutions, and supportive regulatory frameworks. The U.S. leads this market, followed closely by Canada, which contributes around 15% to the overall market. The regulatory environment is evolving, with initiatives aimed at fostering innovation while ensuring consumer protection. The competitive landscape in North America is robust, featuring key players like Lemonade, Root Insurance, and Oscar Health. These companies leverage technology to enhance customer experience and streamline operations. The presence of venture capital and a strong startup ecosystem further fuels innovation in the insurtech space. As traditional insurers adapt to digital trends, the market is expected to see continued growth and diversification of offerings.

Europe : Emerging Insurtech Market Ecosystem

Europe continues to mature as a key insurtech hub, with collaborative ecosystems fostering innovation and cross-border expansion. Europe is witnessing a significant transformation in the insurtech market, with a market share of approximately 30%. The growth is propelled by increasing digitalization, changing consumer preferences, and regulatory support for innovative insurance solutions. Germany and the UK are the largest markets, accounting for about 12% and 10% respectively. The European Union's regulatory framework encourages competition and innovation, which is vital for the sector's expansion. Leading countries like Germany, the UK, and France are home to numerous insurtech startups and established players such as Wefox and Zego. The competitive landscape is characterized by collaboration between traditional insurers and tech startups, fostering a dynamic environment for innovation. As the market matures, the focus is shifting towards personalized insurance products and enhanced customer engagement strategies.

Asia-Pacific : Rapid Growth and Adoption

Asia-Pacific represents one of the fastest-growing regions in the insurtech market, supported by digital inclusion initiatives and mobile insurance adoption. The Asia-Pacific region is rapidly emerging as a significant player in the insurtech market, holding approximately 20% of the global share. The growth is fueled by increasing smartphone penetration, a young population, and a rising middle class demanding more accessible insurance solutions. China and India are the largest markets, contributing around 10% and 5% respectively. Regulatory bodies are increasingly supportive, promoting digital insurance initiatives to enhance financial inclusion. Countries like China, India, and Australia are witnessing a surge in insurtech startups, with key players like Trōv and other local firms leading the charge. The competitive landscape is vibrant, with a mix of traditional insurers and new entrants innovating to meet consumer needs. As the market evolves, there is a strong emphasis on leveraging technology to improve customer experience and operational efficiency.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is gradually emerging in the insurtech landscape, holding about 5% of the global market share. MEA is gradually adopting insurtech solutions, with increasing emphasis on microinsurance and digital accessibility. The growth is driven by increasing internet penetration, a young demographic, and a growing awareness of insurance products. Countries like South Africa and the UAE are leading the market, contributing approximately 3% and 1% respectively. Regulatory frameworks are evolving to support innovation and attract investment in the insurtech sector. In South Africa and the UAE, several startups are entering the market, focusing on digital solutions to enhance customer engagement. The competitive landscape is characterized by a mix of local and international players, with a focus on microinsurance and tailored products to meet the unique needs of the region. As the market matures, there is potential for significant growth driven by technological advancements and changing consumer behaviors.