Technological Advancements

The insurtech market in Canada is experiencing a surge in technological advancements, particularly in artificial intelligence (AI) and machine learning. These technologies enable insurers to analyze vast amounts of data, leading to more accurate risk assessments and personalized insurance products. For instance, AI-driven chatbots are enhancing customer service by providing instant responses to inquiries. Furthermore, the integration of blockchain technology is improving transparency and security in transactions. According to recent data, the adoption of AI in the insurance sector could potentially increase operational efficiency by up to 30%. This technological evolution is likely to reshape the competitive landscape of the insurtech market.

Consumer Demand for Customization

There is a growing consumer demand for personalized insurance solutions within the insurtech market in Canada. Customers increasingly seek tailored products that meet their specific needs, rather than one-size-fits-all policies. This shift is prompting insurers to leverage data analytics to create customized offerings. For example, usage-based insurance models allow consumers to pay premiums based on their actual usage patterns, which can lead to savings of up to 20%. As consumers become more aware of their options, the insurtech market is likely to evolve to accommodate these preferences, fostering innovation and competition among providers.

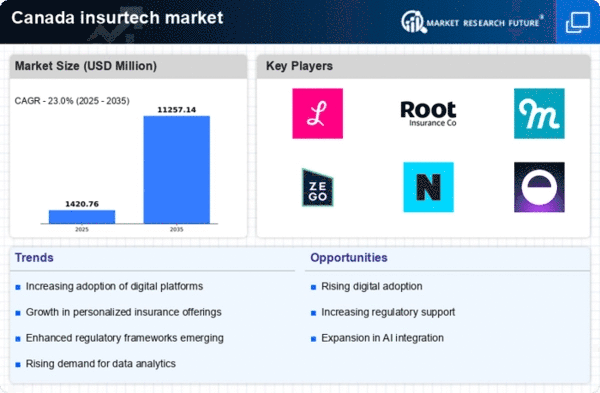

Increased Investment in Insurtech

Investment in the insurtech market in Canada is on the rise, driven by venture capital and private equity interest. In recent years, funding for insurtech startups has surged, with investments reaching approximately $1.5 billion in 2025 alone. This influx of capital is enabling companies to develop innovative solutions and expand their market presence. Investors are particularly interested in technologies that enhance customer experience and streamline operations. As a result, the insurtech market is likely to witness a wave of new entrants and disruptive innovations, further transforming the insurance landscape.

Regulatory Support for Innovation

The regulatory environment in Canada is increasingly supportive of innovation within the insurtech market. Regulatory bodies are recognizing the need to adapt to technological changes and are implementing frameworks that encourage innovation while ensuring consumer protection. For instance, initiatives aimed at fostering sandbox environments allow startups to test their products in a controlled setting. This regulatory flexibility is likely to stimulate growth and attract new players to the insurtech market, as companies can experiment with novel solutions without facing immediate compliance burdens.

Shift Towards Digital Distribution Channels

The shift towards digital distribution channels is reshaping the insurtech market in Canada. Consumers are increasingly preferring online platforms for purchasing insurance products, driven by convenience and accessibility. This trend is prompting traditional insurers to enhance their digital capabilities and invest in user-friendly interfaces. Data indicates that online insurance sales have grown by over 40% in the past year, reflecting a significant change in consumer behavior. As digital channels become the primary mode of distribution, the insurtech market is likely to see a transformation in how products are marketed and sold.