Growing Economic Stability

Economic stability in various regions is contributing to the growth of the Insurance Protection Products Market. As economies recover and grow, individuals and businesses are more willing to invest in insurance products that offer protection against unforeseen events. Increased disposable income allows consumers to prioritize insurance as a means of financial security. Furthermore, businesses are recognizing the importance of insurance in mitigating risks associated with operations and investments. Recent data indicates that global economic growth is projected to remain steady, which could further enhance the demand for insurance protection products. This economic backdrop is likely to bolster the Insurance Protection Products Market, as more stakeholders seek to safeguard their financial interests.

Increasing Regulatory Support

The evolving regulatory landscape is playing a crucial role in shaping the Insurance Protection Products Market. Governments worldwide are implementing policies that promote transparency and consumer protection, which in turn fosters trust in insurance products. Regulatory bodies are also encouraging the development of new insurance solutions to meet the changing needs of consumers. For example, the introduction of regulations that support digital insurance platforms has made it easier for consumers to access a variety of protection products. This supportive regulatory environment is expected to stimulate growth in the Insurance Protection Products Market, as it encourages both innovation and consumer engagement.

Demographic Shifts and Urbanization

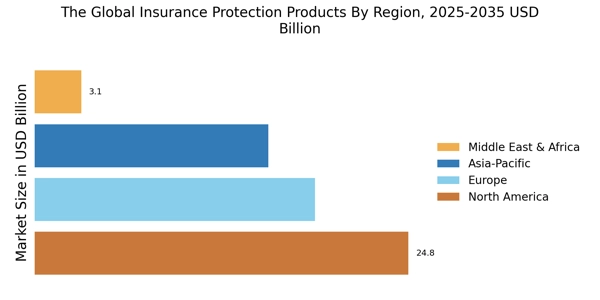

Demographic shifts, particularly urbanization and an aging population, are influencing the Insurance Protection Products Market. As more individuals migrate to urban areas, there is a growing need for insurance products that cater to the unique risks associated with urban living, such as property and health insurance. Additionally, the aging population is driving demand for life and health insurance products that provide long-term care and financial security. According to recent statistics, urban populations are projected to increase significantly, which may lead to a corresponding rise in the demand for insurance protection products. This demographic trend is likely to create new opportunities within the Insurance Protection Products Market.

Rising Awareness of Risk Management

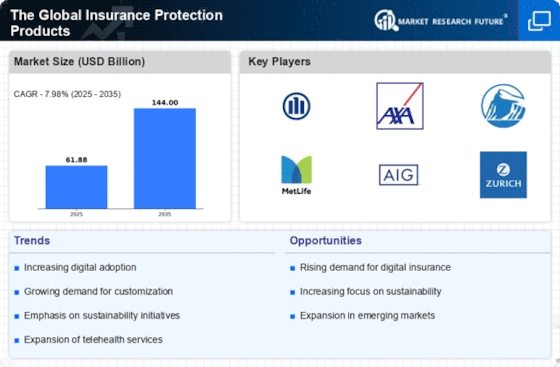

The increasing awareness of risk management among individuals and businesses appears to be a pivotal driver for the Insurance Protection Products Market. As consumers become more cognizant of potential financial risks, they are more inclined to seek insurance solutions that provide comprehensive coverage. This trend is reflected in the growing demand for various protection products, including life, health, and property insurance. In recent years, the market has seen a notable uptick, with The Global Insurance Protection Products projected to reach approximately 7 trillion USD by 2025. This heightened awareness is likely to propel the growth of the Insurance Protection Products Market, as consumers prioritize safeguarding their assets and well-being.

Technological Advancements in Insurance

Technological advancements are reshaping the Insurance Protection Products Market, facilitating enhanced customer experiences and operational efficiencies. Innovations such as artificial intelligence, big data analytics, and blockchain technology are being integrated into insurance processes, allowing for more accurate risk assessments and personalized product offerings. For instance, the use of AI in underwriting processes has streamlined operations, reducing costs and improving service delivery. The Global Insurance Protection Products is expected to grow significantly, indicating a strong correlation with the expansion of the Insurance Protection Products Market. As technology continues to evolve, it is likely to drive further innovation and competition within the sector.