Rising Geriatric Population

The rising geriatric population is a critical driver for the Insulin Glargine Market. As the global population ages, the incidence of age-related chronic conditions, including diabetes, is increasing. Older adults often require long-acting insulin formulations to manage their blood glucose levels effectively. This demographic shift is likely to result in a higher demand for Insulin Glargine Market, as it is well-suited for the management of diabetes in elderly patients. Furthermore, healthcare systems are adapting to meet the needs of this growing population, which may include enhanced access to diabetes care and insulin therapies. The increasing focus on geriatric healthcare is expected to further propel the Insulin Glargine Market, as stakeholders recognize the importance of tailored treatment options for older adults.

Growing Awareness and Education

The growing awareness and education surrounding diabetes management are significant factors influencing the Insulin Glargine Market. Health organizations and advocacy groups are actively promoting diabetes education, which emphasizes the importance of insulin therapy in managing the condition. This heightened awareness is likely to lead to an increase in the number of patients seeking treatment options, including Insulin Glargine Market. Additionally, educational initiatives aimed at healthcare professionals are enhancing their understanding of insulin therapies, thereby improving patient outcomes. As more individuals become informed about the benefits of long-acting insulin, the demand for Insulin Glargine Market is expected to rise. This trend is further supported by the increasing number of diabetes management programs that incorporate insulin education, ultimately driving growth in the Insulin Glargine Market.

Regulatory Support and Approvals

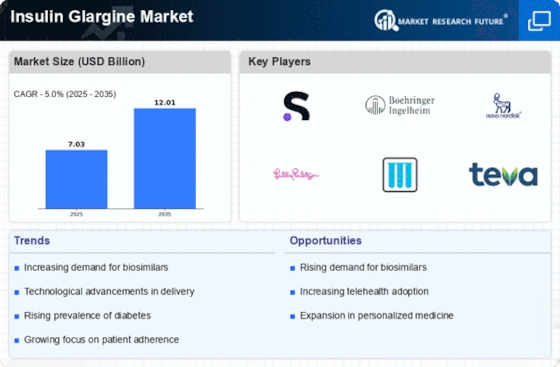

Regulatory support and approvals are pivotal in shaping the landscape of the Insulin Glargine Market. Regulatory agencies are increasingly recognizing the need for accessible diabetes treatments, leading to streamlined approval processes for new insulin products. This supportive regulatory environment encourages pharmaceutical companies to invest in the development of innovative insulin therapies, including Insulin Glargine Market. As a result, the market is witnessing a surge in the introduction of new formulations and delivery methods, which cater to the diverse needs of patients. Moreover, the approval of biosimilars is expected to enhance competition within the Insulin Glargine Market, potentially leading to reduced prices and improved access for patients. This regulatory momentum is likely to foster a more dynamic market, ultimately benefiting individuals living with diabetes.

Advancements in Drug Formulations

Innovations in drug formulations are playing a crucial role in shaping the Insulin Glargine Market. The development of biosimilars and novel delivery mechanisms has the potential to enhance the efficacy and convenience of insulin therapies. For instance, the introduction of pre-filled pens and smart insulin delivery devices is likely to improve patient adherence to treatment regimens. These advancements not only facilitate easier administration but also provide patients with more control over their diabetes management. As a result, the market for Insulin Glargine Market is expected to expand, driven by the increasing availability of user-friendly delivery systems. Furthermore, the competitive landscape is evolving, with various manufacturers investing in research and development to create innovative formulations that meet the diverse needs of patients in the Insulin Glargine Market.

Increasing Prevalence of Diabetes

The rising prevalence of diabetes is a primary driver for the Insulin Glargine Market. As the number of individuals diagnosed with diabetes continues to escalate, the demand for effective insulin therapies, including Insulin Glargine Market, is likely to increase. According to recent estimates, approximately 463 million adults are living with diabetes, a figure projected to rise significantly in the coming years. This growing patient population necessitates the availability of long-acting insulin options, which are essential for managing blood glucose levels effectively. Consequently, pharmaceutical companies are focusing on expanding their portfolios to include Insulin Glargine Market, thereby enhancing their market presence in the Insulin Glargine Market. The increasing awareness of diabetes management and the importance of insulin therapy further contribute to the market's growth.