Research Methodology on Insulin Biosimilars Market

Introduction:

The Market Research Future report titled ‘Insulin Biosimilars Market - Forecast to 2030’ is a comprehensive study that provides market insights into the current and future trends in the global insulin biosimilars industry. The focus of this research is to analyse and estimate the market size and future growth potential of the insulin biosimilars market. This market has been gaining an increasing amount of attention recently due to its potential to provide cost-effective alternatives to expensive biopharmaceuticals. The report is designed to provide an in-depth analysis of the market drivers, restraints, opportunities, and challenges that have an impact on the market.

Research Methodology:

The research methodology adopted for the Market Research Future’s (MRF) report on Insulin Biosimilars Market - Forecast to 2030 includes a comprehensive market analysis with inputs from industry experts. The overall market has been divided into several segments and sub-segments, taking into consideration the product types, applications, major regions, and key players.

The market size estimation and forecasts for the Insulin Biosimilars Market - Forecast to 2030 are obtained through the application of various secondary and primary sources. The data obtained from these sources is then validated by a set of market experts. Various assumptions are also made during the research process such as current market trends and dynamics, current macro- and micro-economic indicators, and other related factors.

The key data points obtained from the secondary sources include an analysis of the global insulin biosimilar market players, product types, applications, major regions, and major countries. A bottom-up market approach has been adopted to estimate the overall global market size. The top-down approach has been used to validate the market size estimated based on the bottom-up approach.

In order to obtain an accurate and comprehensive market estimation and forecasts for the Insulin Biosimilars Market - Forecast to 2030, primary research has been carried out. This included primary interviews with industry experts and market participants. The primary research process included interviews with various companies and industry experts. The questionnaire-based interviews were conducted using a combination of face-to-face, telephone, and online interviews.

Data Analysis and Interpretation:

The market analysis process includes the evaluation of secondary sources, primary sources, and expert interviews to generate market data. The market data is then analyzed and validated using statistical and econometric techniques such as principal component analysis, correlation analysis, multi-variate analysis, K-means clustering, etc. The market analysis also involves the estimation of the market size and future growth potential of the insulin biosimilar industry. This is done by taking into consideration the current market trends, expected market size, and future trends in the global insulin biosimilar industry.

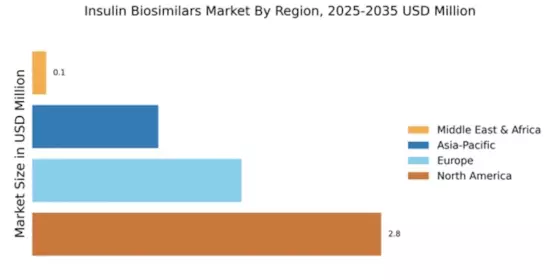

The Market Research Future report on Insulin Biosimilars Market - Forecast to 2030 provides a detailed overview of the market. The report covers the overview and definition of the insulin biosimilar market as well as the product types and applications. It also provides an in-depth analysis of market drivers, restraints, opportunities, and challenges for the insulin biosimilar market. It also covers market segmentation based on product types, applications, major regions, and key players. The report also provides a detailed analysis of the regional markets in terms of market size, growth, and future trends. The report also covers the competitive landscape and SWOT analysis of major players in the insulin biosimilar industry.

Conclusion:

The Market Research Future report on Insulin Biosimilars Market - Forecast to 2030 provides an in-depth analysis of the global insulin biosimilar market and is designed to provide valuable insights to industry stakeholders. The report focuses on the various market dynamics such as market drivers, restraints, opportunities, and challenges. The report also provides a detailed analysis of the regional markets in terms of market size, growth, and future trends. The report also provides a detailed analysis of the competitive landscape and a SWOT analysis of major players in the insulin biosimilar industry.