Growth of the Manufacturing Sector

The manufacturing sector's growth is a significant driver for the Inspection Analysis Device Market. As production scales up, the need for effective inspection solutions becomes increasingly critical to ensure product quality and operational efficiency. The rise of smart manufacturing and Industry 4.0 initiatives has further accelerated this trend, with manufacturers seeking advanced inspection devices that integrate seamlessly into automated processes. The market is anticipated to expand, with projections indicating a potential increase in demand for inspection devices by over 10% annually, reflecting the sector's commitment to maintaining high standards in production.

Rising Demand for Quality Assurance

Quality assurance remains a pivotal driver in the Inspection Analysis Device Market. As industries strive to maintain high standards, the need for reliable inspection devices becomes paramount. Sectors such as automotive, aerospace, and pharmaceuticals are particularly focused on ensuring product quality and compliance with stringent regulations. The market for inspection devices is projected to reach approximately USD 5 billion by 2026, driven by this increasing emphasis on quality. Companies are investing in advanced inspection technologies to mitigate risks associated with product failures and recalls, thereby reinforcing the importance of quality assurance in their operational strategies.

Increased Focus on Safety and Compliance

Safety and compliance are critical factors influencing the Inspection Analysis Device Market. Regulatory bodies across various sectors are imposing stricter guidelines to ensure safety standards are met. This has led to a heightened demand for inspection devices that can accurately assess compliance with these regulations. Industries such as food and beverage, pharmaceuticals, and construction are particularly affected, as non-compliance can result in severe penalties. The market is expected to grow as companies prioritize investments in inspection technologies that facilitate adherence to safety standards, thereby enhancing their operational integrity and reputation.

Emergence of Predictive Maintenance Strategies

Predictive maintenance strategies are gaining traction within the Inspection Analysis Device Market. Companies are increasingly adopting these strategies to minimize downtime and enhance operational efficiency. By utilizing advanced inspection devices equipped with predictive analytics capabilities, organizations can identify potential equipment failures before they occur. This proactive approach not only reduces maintenance costs but also extends the lifespan of machinery. The market for inspection devices is likely to benefit from this trend, with forecasts suggesting a robust growth trajectory as industries recognize the value of integrating predictive maintenance into their operational frameworks.

Technological Advancements in Inspection Devices

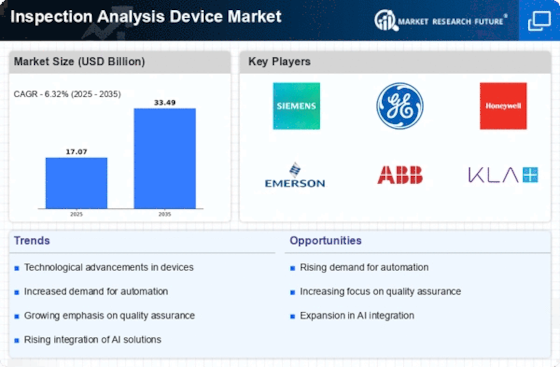

The Inspection Analysis Device Market is experiencing a surge in technological advancements, particularly in sensor technology and imaging systems. Innovations such as high-resolution cameras and advanced sensors enhance the accuracy and efficiency of inspections. For instance, the integration of 3D imaging and real-time data processing allows for more detailed analysis, which is crucial in sectors like manufacturing and construction. As industries increasingly adopt these advanced inspection devices, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 8% in the coming years. This trend indicates a strong demand for sophisticated inspection solutions that can meet the evolving needs of various sectors.