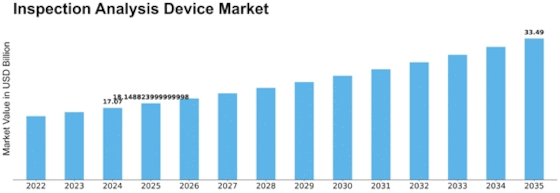

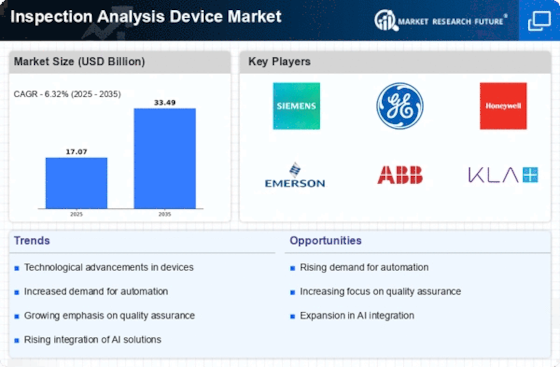

Inspection Analysis Device Size

Inspection Analysis Device Market Growth Projections and Opportunities

The inspection analysis device market is influenced by several key factors that shape its dynamics, growth, and overall trajectory. One significant factor is technological innovation. Advancements in technology drive the development of more sophisticated inspection analysis devices with enhanced capabilities, such as higher accuracy, faster processing speeds, and greater versatility. These technological innovations not only improve the performance of inspection devices but also open up new opportunities for applications across various industries, driving demand and market growth.

Moreover, regulatory requirements play a crucial role in shaping the inspection analysis device market. Government regulations and industry standards mandate the use of inspection devices to ensure compliance with safety, quality, and environmental regulations. As regulatory requirements become more stringent and complex, businesses are compelled to invest in advanced inspection technologies to meet compliance standards and avoid penalties or legal consequences. This creates a steady demand for inspection analysis devices, particularly in industries with strict regulatory oversight, such as healthcare, pharmaceuticals, and food manufacturing.

Additionally, market factors such as economic conditions and industry trends influence the demand for inspection analysis devices. Economic factors like GDP growth, industrial output, and investment levels impact the overall demand for inspection devices, as businesses may prioritize cost-saving measures during periods of economic downturn or invest in automation and quality control technologies during periods of growth. Industry trends, such as the shift towards sustainable practices or the adoption of digitalization and Industry 4.0 technologies, also drive demand for inspection analysis devices tailored to meet emerging needs and challenges.

Furthermore, competition within the inspection analysis device market is a significant factor influencing market dynamics. As the market becomes increasingly crowded with numerous players offering a wide range of inspection solutions, competition intensifies, driving companies to innovate and differentiate their products to gain a competitive edge. This competitive pressure fosters technological advancements, product diversification, and pricing strategies aimed at capturing market share and meeting the evolving needs of customers.

Moreover, customer preferences and expectations play a crucial role in shaping the inspection analysis device market. Businesses seek inspection solutions that not only meet regulatory requirements but also offer ease of use, reliability, and cost-effectiveness. Customer preferences for specific features, such as portability, connectivity, or data analytics capabilities, drive product development and influence market trends. Additionally, as businesses increasingly prioritize sustainability and environmental responsibility, there is a growing demand for eco-friendly inspection devices that minimize energy consumption, waste generation, and environmental impact.

Furthermore, globalization and international trade impact the inspection analysis device market by creating opportunities for expansion into new markets and increasing competition from foreign manufacturers. As businesses expand their operations globally, they encounter diverse regulatory environments, cultural preferences, and industry standards, driving the need for inspection devices that can adapt to different market conditions and requirements. Additionally, international trade agreements and geopolitical factors can influence market dynamics by affecting trade barriers, tariffs, and supply chain disruptions.

Leave a Comment