Rising Healthcare Expenditure

Healthcare expenditure continues to rise globally, influencing the Global Infusion System Market Industry. Increased investment in healthcare infrastructure and services leads to enhanced access to advanced medical technologies, including infusion systems. Governments and private sectors are allocating substantial resources to improve healthcare delivery, which in turn drives the demand for effective infusion solutions. As healthcare systems evolve, the focus on patient-centered care and efficient treatment modalities becomes paramount. This trend is likely to sustain the market's growth trajectory, as stakeholders prioritize investments in innovative infusion technologies to meet the growing healthcare demands.

Regulatory Support and Standards

Regulatory bodies play a pivotal role in shaping the Global Infusion System Market Industry. The establishment of stringent safety and efficacy standards for infusion devices ensures that only high-quality products reach the market. This regulatory support fosters innovation and encourages manufacturers to develop advanced infusion systems that meet evolving healthcare needs. Compliance with these regulations not only enhances patient safety but also builds trust among healthcare providers and patients. As the market continues to expand, the emphasis on regulatory compliance will likely drive the development of safer and more effective infusion technologies.

Rising Prevalence of Chronic Diseases

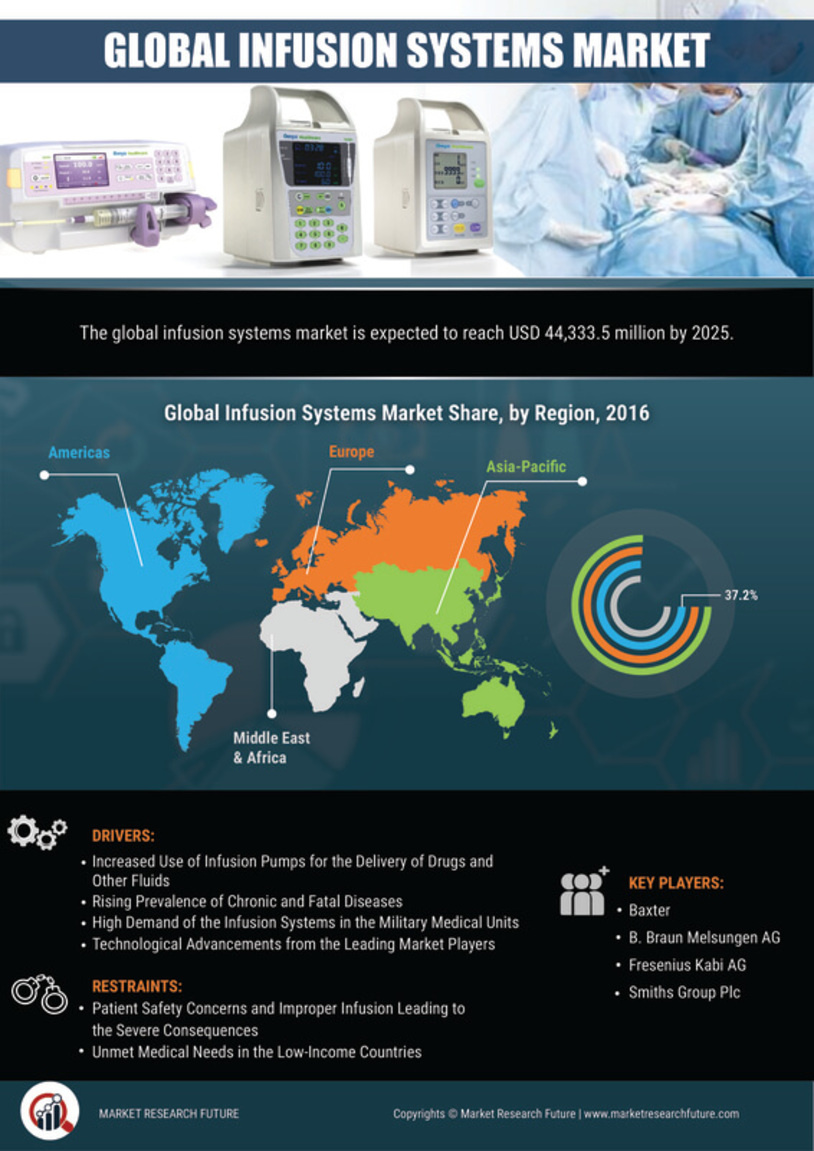

The Global Infusion System Market Industry is witnessing a surge in demand due to the increasing prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders. As of 2024, the market is valued at approximately 5.49 USD Billion, reflecting the urgent need for effective treatment options. Infusion systems play a crucial role in managing these conditions, providing precise medication delivery and improving patient outcomes. The growing aging population further exacerbates this trend, as older individuals are more susceptible to chronic illnesses. This demographic shift suggests that the market will continue to expand, driven by the need for advanced infusion technologies.

Technological Advancements in Infusion Systems

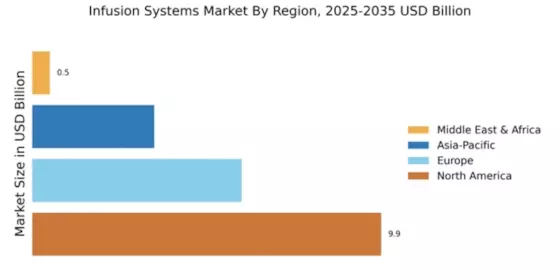

Technological innovations are significantly shaping the Global Infusion System Market Industry. The introduction of smart infusion pumps, which offer features like dose error reduction systems and wireless connectivity, enhances patient safety and treatment efficacy. These advancements are likely to increase the adoption of infusion systems across healthcare settings. The market is projected to grow at a compound annual growth rate of 10.55% from 2025 to 2035, indicating a robust demand for these technologies. As healthcare providers seek to improve operational efficiency and patient care, the integration of advanced technologies into infusion systems becomes increasingly vital.

Increasing Demand for Home Healthcare Solutions

The Global Infusion System Market Industry is experiencing a notable shift towards home healthcare solutions. Patients are increasingly opting for home-based treatments due to the convenience and comfort they offer. Infusion systems designed for home use enable patients to receive necessary therapies without frequent hospital visits. This trend is particularly relevant for chronic disease management, where continuous treatment is essential. As the market evolves, the demand for portable and user-friendly infusion devices is expected to rise, contributing to the overall market growth. The projected market value of 16.5 USD Billion by 2035 underscores the potential of this segment.