Rising Water Scarcity

The Global Biological Wastewater Treatment Industry is also being propelled by the growing concern over water scarcity. As freshwater resources become increasingly limited due to population growth and climate change, the need for effective wastewater treatment and reuse is becoming more critical. Biological treatment processes can facilitate the recycling of wastewater for agricultural and industrial applications, thereby alleviating pressure on freshwater supplies. This trend is particularly evident in arid regions, where treated wastewater is essential for sustainable water management. The increasing emphasis on water conservation is likely to drive investments in biological treatment technologies, contributing to the market's projected growth.

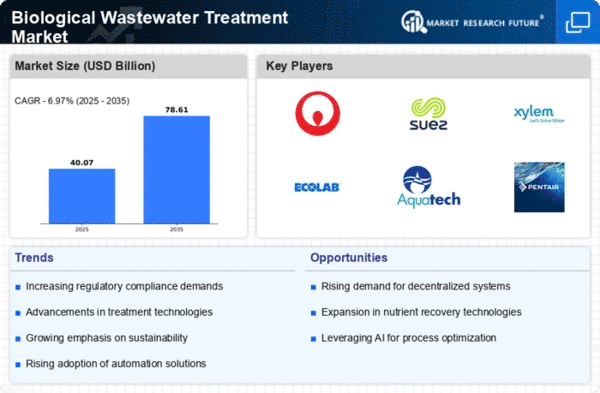

Market Growth Projections

The Global Biological Wastewater Treatment Market Industry is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of 6.99% from 2025 to 2035. This growth trajectory is driven by various factors, including technological advancements, regulatory pressures, and increasing public awareness of environmental issues. As industries continue to prioritize sustainable wastewater management practices, the demand for biological treatment solutions is expected to rise significantly. The market's expansion reflects a broader trend towards resource recovery and environmental protection, positioning biological treatment as a key component of future wastewater management strategies.

Technological Advancements

Innovations in biological wastewater treatment technologies are significantly influencing the Global Biological Wastewater Treatment Market Industry. The development of advanced treatment processes, such as membrane bioreactors and integrated fixed-film activated sludge systems, enhances efficiency and reduces operational costs. These technologies not only improve treatment performance but also facilitate the recovery of valuable resources, such as nutrients and biogas. The adoption of such innovations is expected to drive market growth, as industries increasingly recognize the benefits of modernized treatment solutions. By 2035, the market is anticipated to expand to 78.8 USD Billion, underscoring the role of technology in shaping wastewater management practices.

Increasing Regulatory Pressure

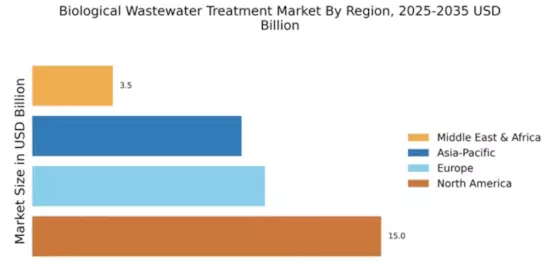

The Global Biological Wastewater Treatment Market Industry is experiencing heightened regulatory scrutiny aimed at improving water quality and environmental sustainability. Governments worldwide are implementing stringent regulations to control wastewater discharge, thereby driving the demand for biological treatment solutions. For instance, the European Union's Water Framework Directive mandates member states to achieve good ecological status for water bodies, which necessitates advanced treatment technologies. This regulatory landscape is likely to propel the market, as industries seek compliance through effective biological treatment methods. As a result, the market is projected to reach 37.5 USD Billion in 2024, reflecting the urgency for compliance-driven investments.

Public Awareness and Environmental Concerns

There is a notable increase in public awareness regarding environmental issues, which is influencing the Global Biological Wastewater Treatment Market Industry. Communities are becoming more conscious of the impacts of untreated wastewater on ecosystems and public health. This heightened awareness is prompting both consumers and businesses to advocate for sustainable practices, including the adoption of biological treatment solutions. As a result, industries are increasingly investing in eco-friendly technologies to meet consumer expectations and regulatory requirements. This shift towards sustainability is expected to bolster the market, as organizations strive to enhance their environmental stewardship and reduce their ecological footprint.