Rising Demand for Heavy Machinery

The Industrial Tire Market experiences a notable increase in demand for heavy machinery, driven by the expansion of construction and mining sectors. As infrastructure projects proliferate, the need for robust tires that can withstand harsh conditions becomes paramount. In 2025, the construction sector is projected to grow by approximately 5%, which directly correlates with the rising demand for industrial tires. Heavy machinery, such as excavators and bulldozers, requires specialized tires that offer durability and performance. This trend indicates a sustained growth trajectory for the Industrial Tire Market, as manufacturers adapt to meet the evolving needs of these sectors.

Increased Focus on Safety Standards

Safety regulations play a crucial role in shaping the Industrial Tire Market. As industries prioritize worker safety, the demand for tires that meet stringent safety standards is likely to rise. Enhanced safety features, such as improved traction and puncture resistance, are becoming essential for industrial applications. In 2025, it is anticipated that compliance with safety regulations will drive a 10% increase in the adoption of high-performance industrial tires. This focus on safety not only protects workers but also minimizes operational downtime, thereby enhancing productivity. Consequently, manufacturers are compelled to innovate and produce tires that align with these heightened safety expectations.

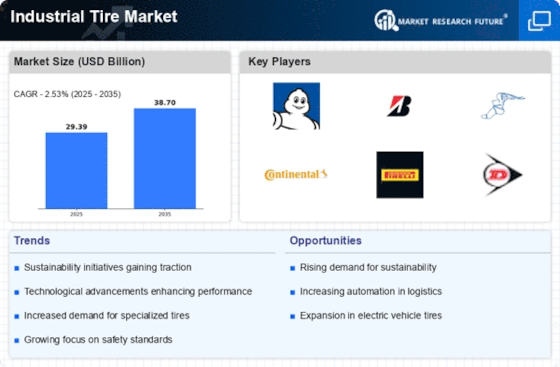

Sustainability and Eco-friendly Practices

Sustainability initiatives are becoming increasingly relevant within the Industrial Tire Market. As companies strive to reduce their environmental footprint, the demand for eco-friendly tires is on the rise. Manufacturers are exploring sustainable materials and production methods to create tires that are both high-performing and environmentally responsible. In 2025, it is estimated that the market for sustainable industrial tires will grow by 12%, reflecting a shift towards greener practices. This trend not only aligns with corporate social responsibility goals but also appeals to environmentally conscious consumers. As a result, the Industrial Tire Market is likely to see a transformation driven by sustainability.

Growth of E-commerce and Logistics Sectors

The Industrial Tire Market is significantly influenced by the rapid growth of e-commerce and logistics sectors. As online shopping continues to expand, the demand for efficient transportation and warehousing solutions increases. This growth necessitates the use of industrial vehicles, such as forklifts and delivery trucks, which rely on high-quality tires for optimal performance. In 2025, the logistics sector is projected to grow by 7%, further driving the demand for industrial tires. Consequently, manufacturers are focusing on developing tires that cater specifically to the needs of the logistics industry, thereby enhancing their market presence within the Industrial Tire Market.

Technological Innovations in Tire Manufacturing

The Industrial Tire Market is witnessing a surge in technological innovations that enhance tire performance and longevity. Advancements in materials science and manufacturing processes are enabling the production of tires that offer superior durability and efficiency. For instance, the introduction of smart tires equipped with sensors is gaining traction, providing real-time data on tire health and performance. This trend is expected to contribute to a 15% increase in the market for technologically advanced tires by 2026. As industries seek to optimize their operations, the demand for innovative tire solutions is likely to shape the future landscape of the Industrial Tire Market.