Growth of Cold Chain Logistics

The Industrial Refrigeration Compressor Market is poised for growth due to the expansion of cold chain logistics. As e-commerce and online grocery shopping continue to rise, the demand for efficient refrigeration solutions in transportation and storage is becoming increasingly critical. In 2025, the cold chain logistics sector is projected to experience a compound annual growth rate of approximately 8%, significantly impacting the refrigeration compressor market. This growth is driven by the need for reliable temperature control to preserve the quality of perishable goods. Consequently, manufacturers are likely to invest in advanced refrigeration technologies to meet the evolving demands of the cold chain, thereby enhancing the overall market dynamics.

Increasing Focus on Sustainability

Sustainability is becoming a central theme within the Industrial Refrigeration Compressor Market. As businesses strive to reduce their carbon footprint, there is a growing emphasis on adopting eco-friendly refrigerants and energy-efficient systems. In 2025, it is anticipated that the market will see a shift towards sustainable practices, with a projected increase in the use of natural refrigerants such as ammonia and carbon dioxide. This transition not only aligns with global sustainability goals but also offers companies the potential for cost savings through reduced energy consumption. The increasing focus on sustainability is likely to drive innovation in compressor technology, positioning the market for long-term growth and resilience.

Regulatory Support for Energy Efficiency

The Industrial Refrigeration Compressor Market is benefiting from increasing regulatory support aimed at promoting energy efficiency. Governments across various regions are implementing stringent regulations and standards that encourage the adoption of energy-efficient refrigeration systems. In 2025, it is expected that compliance with these regulations will drive a substantial portion of the market growth, as businesses seek to align with environmental standards and reduce operational costs. The introduction of incentives and rebates for energy-efficient technologies further enhances this trend, making it financially viable for companies to invest in modern refrigeration compressors. This regulatory landscape not only fosters innovation but also positions the market for sustained growth in the coming years.

Rising Demand in Food and Beverage Sector

The Industrial Refrigeration Compressor Market is experiencing a notable surge in demand, particularly driven by the food and beverage sector. As consumer preferences shift towards fresh and frozen products, the need for efficient refrigeration systems becomes paramount. In 2025, the food and beverage industry is projected to account for a substantial share of the market, with estimates suggesting it could represent over 40% of total industrial refrigeration compressor sales. This trend indicates a robust growth trajectory, as manufacturers strive to meet the increasing requirements for temperature-controlled storage and transportation. Furthermore, the expansion of food processing facilities and cold chain logistics is likely to further bolster the demand for advanced refrigeration compressors, thereby enhancing the overall market landscape.

Technological Advancements in Compressor Design

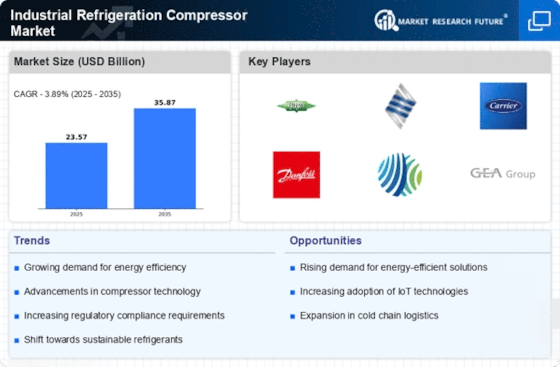

Technological innovations are playing a crucial role in shaping the Industrial Refrigeration Compressor Market. Recent advancements in compressor design, such as the development of variable speed drives and enhanced heat exchange technologies, are contributing to improved efficiency and performance. These innovations not only reduce energy consumption but also extend the lifespan of refrigeration systems. In 2025, it is anticipated that the market will witness a significant increase in the adoption of these advanced technologies, with projections indicating a potential growth rate of around 6% annually. This trend reflects a broader industry shift towards more sustainable and cost-effective refrigeration solutions, as companies seek to optimize their operations and reduce environmental impact.