Growth of the Cold Chain Logistics Sector

The growth of the cold chain logistics sector is significantly impacting the Refrigeration and Air Conditioning Compressor Market. As the demand for perishable goods increases, the need for efficient refrigeration systems in transportation and storage becomes paramount. The cold chain logistics market is projected to expand at a robust rate, driven by the rising consumption of frozen and chilled products. This growth necessitates advanced refrigeration systems, which in turn drives the demand for high-performance compressors. Consequently, manufacturers are focusing on developing specialized compressors tailored for cold chain applications, thereby enhancing the overall efficiency and reliability of the Refrigeration and Air Conditioning Compressor Market.

Increasing Consumer Awareness of Energy Costs

Increasing consumer awareness of energy costs is shaping the Refrigeration and Air Conditioning Compressor Market. As energy prices continue to rise, consumers are becoming more conscious of the operational costs associated with their refrigeration and air conditioning systems. This awareness is driving demand for energy-efficient compressors that can help reduce electricity bills. Market Research Future indicates that consumers are willing to invest in higher upfront costs for compressors that promise long-term savings through energy efficiency. This trend is prompting manufacturers to prioritize the development of energy-efficient solutions, thereby influencing the overall dynamics of the Refrigeration and Air Conditioning Compressor Market.

Technological Advancements in Compressor Design

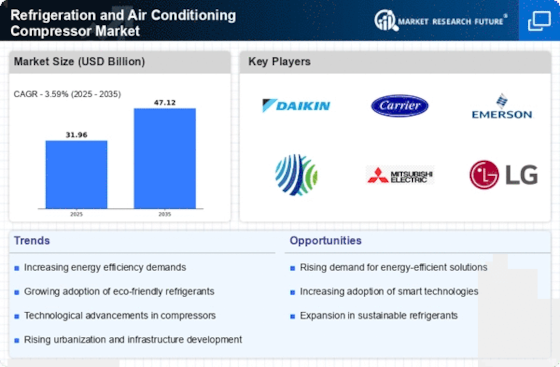

Technological advancements in compressor design are significantly influencing the Refrigeration and Air Conditioning Compressor Market. Innovations such as variable speed compressors and inverter technology are enhancing energy efficiency and performance. These advancements allow for better temperature control and reduced energy consumption, which is increasingly important in a world focused on sustainability. Market data indicates that energy-efficient compressors can reduce energy usage by up to 30%, making them a preferred choice among consumers and businesses alike. As manufacturers continue to invest in research and development, the Refrigeration and Air Conditioning Compressor Market is likely to witness a surge in the adoption of these advanced technologies, further driving market growth.

Regulatory Pressure for Energy Efficiency Standards

Regulatory pressure for energy efficiency standards is a crucial driver for the Refrigeration and Air Conditioning Compressor Market. Governments worldwide are implementing stringent regulations aimed at reducing energy consumption and greenhouse gas emissions. For instance, the introduction of minimum energy performance standards (MEPS) has compelled manufacturers to enhance the efficiency of their compressors. Compliance with these regulations not only helps in reducing operational costs for end-users but also aligns with global sustainability goals. As a result, the market is witnessing a shift towards more energy-efficient compressor technologies, which is expected to continue shaping the Refrigeration and Air Conditioning Compressor Market in the coming years.

Rising Demand for Refrigeration and Air Conditioning

The increasing demand for refrigeration and air conditioning systems across various sectors is a primary driver for the Refrigeration and Air Conditioning Compressor Market. As urbanization accelerates, the need for effective cooling solutions in residential, commercial, and industrial applications intensifies. According to recent data, the market for air conditioning units is projected to grow at a compound annual growth rate of approximately 5.5% over the next several years. This growth is largely attributed to rising temperatures and changing climate patterns, which necessitate enhanced cooling solutions. Consequently, manufacturers are compelled to innovate and improve compressor technologies to meet this burgeoning demand, thereby propelling the Refrigeration and Air Conditioning Compressor Market forward.