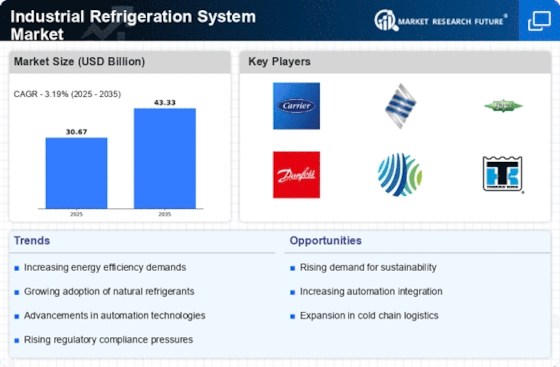

Growth in Food and Beverage Sector

The Industrial Refrigeration System Market is significantly influenced by the expansion of the food and beverage sector. As consumer preferences shift towards fresh and frozen products, the need for reliable refrigeration systems becomes paramount. The food and beverage industry is projected to grow at a compound annual growth rate of approximately 5% over the next few years, driving the demand for robust refrigeration solutions. This growth necessitates the implementation of advanced refrigeration systems that ensure product quality and safety. Consequently, manufacturers in the Industrial Refrigeration System Market are focusing on developing systems that cater specifically to the unique requirements of this sector.

Rising Demand for Energy Efficiency

The Industrial Refrigeration System Market is experiencing a notable shift towards energy-efficient solutions. As industries strive to reduce operational costs and minimize environmental impact, the demand for advanced refrigeration systems that utilize less energy is increasing. According to recent data, energy-efficient refrigeration systems can reduce energy consumption by up to 30% compared to traditional systems. This trend is particularly evident in sectors such as food processing and pharmaceuticals, where maintaining optimal temperatures is crucial. The emphasis on sustainability and compliance with stringent regulations further propels the adoption of energy-efficient technologies in the Industrial Refrigeration System Market.

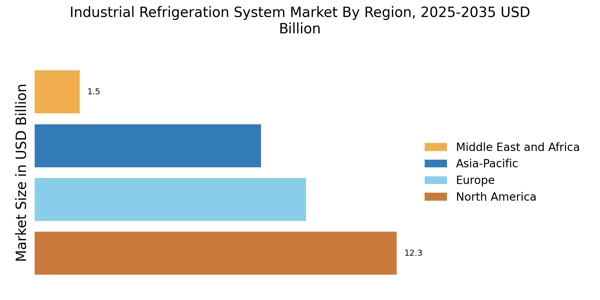

Increasing Focus on Cold Chain Logistics

The Industrial Refrigeration System Market is witnessing a surge in demand due to the increasing focus on cold chain logistics. As global trade expands, the need for efficient cold chain solutions to preserve the quality of perishable goods is becoming more critical. The cold chain equipment logistics is projected to grow significantly, with estimates suggesting a growth rate of around 10% annually. This growth is driving the demand for advanced refrigeration systems that can maintain precise temperature control throughout the supply chain. Consequently, the Industrial Refrigeration System Market is likely to benefit from this trend as companies seek reliable refrigeration solutions to support their cold chain operations.

Regulatory Compliance and Safety Standards

The Industrial Refrigeration System Market is heavily influenced by stringent regulatory compliance and safety standards. Governments and regulatory bodies are implementing rigorous guidelines to ensure the safe operation of refrigeration systems, particularly in sectors such as food processing and pharmaceuticals. Compliance with these regulations often necessitates the adoption of advanced refrigeration technologies that meet safety and environmental standards. As a result, companies are increasingly investing in modern refrigeration systems that not only comply with regulations but also enhance operational safety. This trend is expected to drive growth in the Industrial Refrigeration System Market as businesses prioritize compliance and safety.

Technological Advancements in Refrigeration

Technological innovations are reshaping the Industrial Refrigeration System Market, leading to the development of smarter and more efficient systems. The integration of IoT and automation technologies allows for real-time monitoring and control of refrigeration processes, enhancing operational efficiency. These advancements not only improve energy management but also facilitate predictive maintenance, reducing downtime and operational costs. As industries increasingly adopt these technologies, the Industrial Refrigeration System Market is likely to witness a surge in demand for systems equipped with smart features. This trend indicates a shift towards more sophisticated refrigeration solutions that align with modern industrial needs.