-

Executive Summary

-

Scope of the Report

-

Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

-

Markets Structure

-

Market Research Methodology

-

Research Process

-

Secondary Research

-

Primary Research

-

Forecast Model

-

Market Landscape

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Buyers

- Threat of Substitutes

- Intensity of Rivalry

- Bargaining Power of Suppliers

-

Value Chain/Supply Chain of the Global Industrial Radiography Market

-

Market Overview of the Global Industrial Radiography Market

-

Introduction

-

Growth Drivers

-

Impact Analysis

-

Market Challenges

-

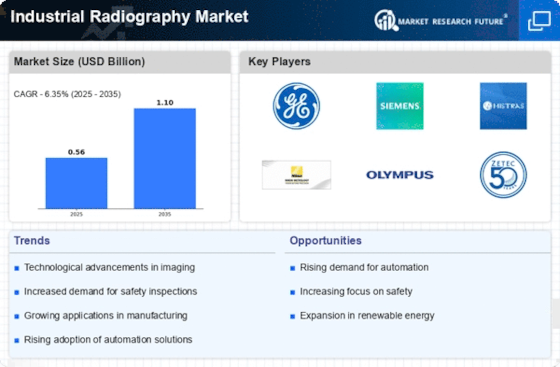

Market Trends

-

Introduction

-

Growth Trends

-

Impact analysis

-

Industrial Radiographys Market, by Component

-

Introduction

-

Hardware

- Market Estimates & Forecast, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Region, 2024 -2032

-

Software

- Market Estimates & Forecast, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Region, 2024 -2032

-

Industrial Radiographys Market, by Imaging Technology

-

Introduction

-

Film-Based Radiography

- Market Estimates & Forecast, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Region, 2024 -2032

-

Digital Radiography

- Market Estimates & Forecast, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Region, 2024 -2032

-

Industrial Radiographys Market, by Radiation Type

-

Introduction

-

X-Rays

- Market Estimates & Forecast, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Region, 2024 -2032

-

Gamma Rays

- Market Estimates & Forecast, 2024 -2032

-

Market Estimates & Industrial Radiographys Market, by Region, 2024 -2032

-

Industrial Radiographys Market, by End-Users

-

Introduction

-

Automotive

- Market Estimates & Forecast, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Region, 2024 -2032

-

Oil & Gas

- Market Estimates & Forecast, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Region, 2024 -2032

-

Consumer Electronics

- Market Estimates & Forecast, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Region, 2024 -2032

-

Aerospace & Defense

- Market Estimates & Forecast, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Region, 2024 -2032

-

Manufacturing

- Market Estimates & Forecast, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Region, 2024 -2032

-

Power Generation

- Market Estimates & Forecast, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Region, 2024 -2032

-

Others

- Market Estimates & Forecast, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Region, 2024 -2032

-

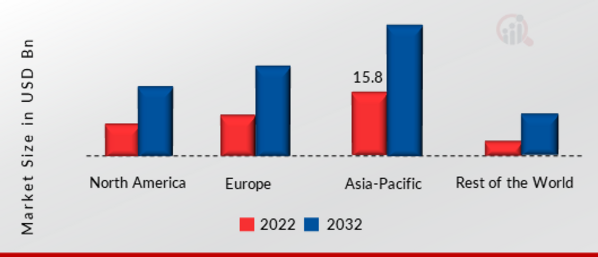

Industrial Radiographys Market, by Region

-

Introduction

-

North America

- Market Estimates & Industrial Radiographys Market, by Country, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Component, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Imaging Technology, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Radiation Type, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by End-Users, 2024 -2032

- US

- Canada

- Mexico

-

Europe

- Market Estimates & Industrial Radiographys Market, by Country, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Component, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Imaging Technology, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Radiation Type, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by End-Users, 2024 -2032

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia-Pacific

- Market Estimates & Industrial Radiographys Market, by Country, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Component, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Imaging Technology, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Radiation Type, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by End-Users, 2024 -2032

- China

- Japan

- India

- Rest of Asia-Pacific

-

Rest of the World

- Market Estimates & Forecast, by, Country, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Component, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Imaging Technology, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by Radiation Type, 2024 -2032

- Market Estimates & Industrial Radiographys Market, by End-Users, 2024 -2032

- The Middle East & Africa

- South America

-

Company Profiles

-

General Electric Company

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Fujifilm Holdings Corporation

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Nikon Corporation

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Shimadzu Corporation

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Baker Hughes

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Anritsu Corporation

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Mettler-Toledo

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

PerkinElmer, Inc.

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

3DX-Ray Ltd.

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Bosello High Technology srl

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

COMET Holding AG

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Conclusion

-

-

LIST OF TABLES

-

Industrial Radiographys Market, by Country, 2024-2032

-

Table2 North America: Industrial Radiographys Market, by Country, 2024 -2032

-

Table3 Europe: Industrial Radiographys Market, by Country, 2024 -2032

-

Table4 Asia-Pacific: Industrial Radiographys Market, by Country, 2024 -2032

-

Table5 South America: Industrial Radiographys Market, by Country, 2024 -2032

-

Table6 North America: Industrial Radiographys Market, by Country, 2024 -2032

-

Table7 North America: Industrial Radiographys Market, by Component, 2024 -2032

-

Table8 North America: Industrial Radiographys Market, by Imaging Technology, 2024 -2032

-

Table9 North America: Industrial Radiographys Market, by Radiation Type, 2024 -2032

-

Table10 North America: Industrial Radiographys Market, by End-Users, 2024 -2032

-

Table11 Europe: Industrial Radiographys Market, by Country, 2024 -2032

-

Table12 Europe: Industrial Radiographys Market, by Component, 2024 -2032

-

Table13 Europe: Industrial Radiographys Market, by Imaging Technology, 2024 -2032

-

Table14 Europe: Industrial Radiographys Market, by Radiation Type, 2024 -2032

-

Table15 Europe: Industrial Radiographys Market, by End-Users, 2024 -2032

-

Table16 Asia-Pacific: Industrial Radiographys Market, by Country, 2024 -2032

-

Industrial Radiographys Market, by Component, 2024 -2032

-

Table18 Asia-Pacific: Industrial Radiographys Market, by Imaging Technology, 2024 -2032

-

Table19 Asia-Pacific: Industrial Radiographys Market, by Radiation Type, 2024 -2032

-

Table20 Asia-Pacific: Industrial Radiographys Market, by End-Users, 2024 -2032

-

Table21 Middle East & Africa: Industrial Radiographys Market, by Country, 2024 -2032

-

Table22 Middle East & Africa: Industrial Radiographys Market, by Component, 2024 -2032

-

Table23 Middle East & Africa: Industrial Radiographys Market, by Imaging Technology, 2024 -2032

-

Table24 Middle East & Africa: Industrial Radiographys Market, by Radiation Type, 2024 -2032

-

Table25 Middle East & Africa: Industrial Radiographys Market, by End-Users, 2024 -2032

-

Table26 South America: Industrial Radiographys Market, by Country, 2024 -2032

-

Table27 South America: Industrial Radiographys Market, by Component, 2024 -2032

-

Table28 South America: Industrial Radiographys Market, by Imaging Technology, 2024 -2032

-

Table29 South America: Industrial Radiographys Market, by Radiation Type, 2024 -2032

-

Table30 South America: Industrial Radiographys Market, by End-Users, 2024 -2032

-

-

LIST OF FIGURES

-

Global Industrial Radiography Market Segmentation

-

Forecast Methodology

-

Porter’s Five Forces Analysis of the Global Industrial Radiography Market

-

Value Chain of the Global Industrial Radiography Market

-

Industrial Radiographys Market, by country (in %)

-

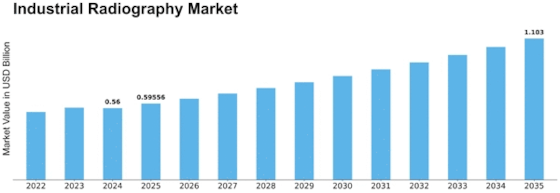

Global Industrial Radiography Market, 2024 -2032

-

Share of the Global Industrial Radiography Market by Industry, 2024 -2032

-

Industrial Radiographys Market, by Component, 2023

-

Industrial Radiographys Market, by Component, 2024 -2032

-

Industrial Radiographys Market, by Imaging Technology, 2020

-

Industrial Radiographys Market, by Imaging Technology, 2024 -2032

-

Industrial Radiographys Market, by Radiation Type, 2023

-

Industrial Radiographys Market, by Radiation Type, 2024 -2032

-

Industrial Radiographys Market, by End-Users, 2023

-

Industrial Radiographys Market, by End-Users, 2024 -2032

Leave a Comment