Growing Demand in Emerging Markets

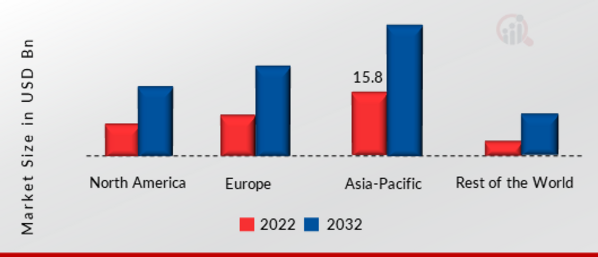

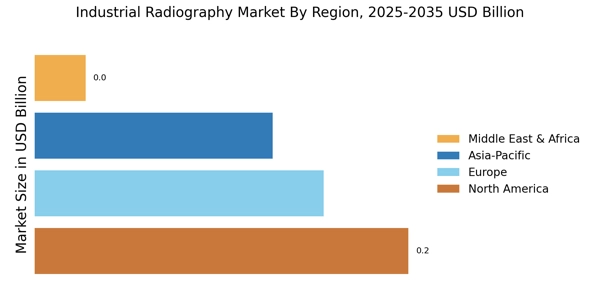

The Industrial Radiography Market is witnessing a surge in demand from emerging markets, where industrialization is rapidly advancing. Countries in Asia-Pacific and Latin America are increasingly adopting industrial radiography techniques to enhance quality control and ensure the integrity of infrastructure projects. The expansion of manufacturing and construction sectors in these regions is contributing to the growth of the market. For instance, the Asia-Pacific region is projected to account for a significant share of the industrial radiography equipment market, driven by rising investments in infrastructure development. This trend indicates a shift in focus towards modern inspection techniques that can meet the demands of expanding industries. As emerging markets continue to evolve, the Industrial Radiography Market is likely to experience robust growth fueled by this increasing demand.

Regulatory Compliance and Safety Standards

The Industrial Radiography Market is heavily influenced by stringent regulatory compliance and safety standards. Governments and international organizations have established rigorous guidelines to ensure the safety of radiographic testing processes. Compliance with these regulations is not only essential for operational integrity but also for maintaining public safety. The increasing emphasis on safety protocols in industries such as oil and gas, nuclear, and manufacturing is propelling the demand for reliable radiographic solutions. As a result, companies are investing in advanced radiography equipment that meets or exceeds regulatory requirements. This trend is likely to continue, as adherence to safety standards is critical for minimizing risks associated with radiographic inspections. The Industrial Radiography Market, therefore, stands to benefit from the ongoing focus on regulatory compliance, which drives innovation and investment in safer technologies.

Increased Investment in Infrastructure Development

The Industrial Radiography Market is benefiting from increased investment in infrastructure development across various regions. Governments and private entities are allocating substantial resources to enhance transportation, energy, and utility infrastructures. This investment necessitates rigorous quality assurance processes, where industrial radiography plays a crucial role. The need for non-destructive testing methods to ensure the safety and reliability of infrastructure projects is driving the demand for radiographic solutions. As infrastructure projects become more complex, the requirement for advanced inspection techniques is likely to grow. The Industrial Radiography Market is poised to capitalize on this trend, as stakeholders seek to mitigate risks associated with structural failures and ensure compliance with safety standards. The ongoing commitment to infrastructure development is expected to sustain the growth trajectory of the market.

Rising Awareness of Non-Destructive Testing Benefits

The Industrial Radiography Market is experiencing a heightened awareness of the benefits associated with non-destructive testing (NDT) methods. Industries are increasingly recognizing that NDT techniques, including radiography, provide critical insights into material integrity without compromising the structural integrity of components. This awareness is leading to a broader acceptance of industrial radiography as a standard practice in quality assurance processes. The ability to detect internal flaws and defects in materials is becoming essential for industries such as aerospace, automotive, and manufacturing. As companies strive to enhance product quality and safety, the demand for industrial radiography solutions is likely to rise. The Industrial Radiography Market is thus positioned to grow as more organizations adopt NDT practices, driven by the need for reliable and efficient inspection methods.

Technological Advancements in Industrial Radiography

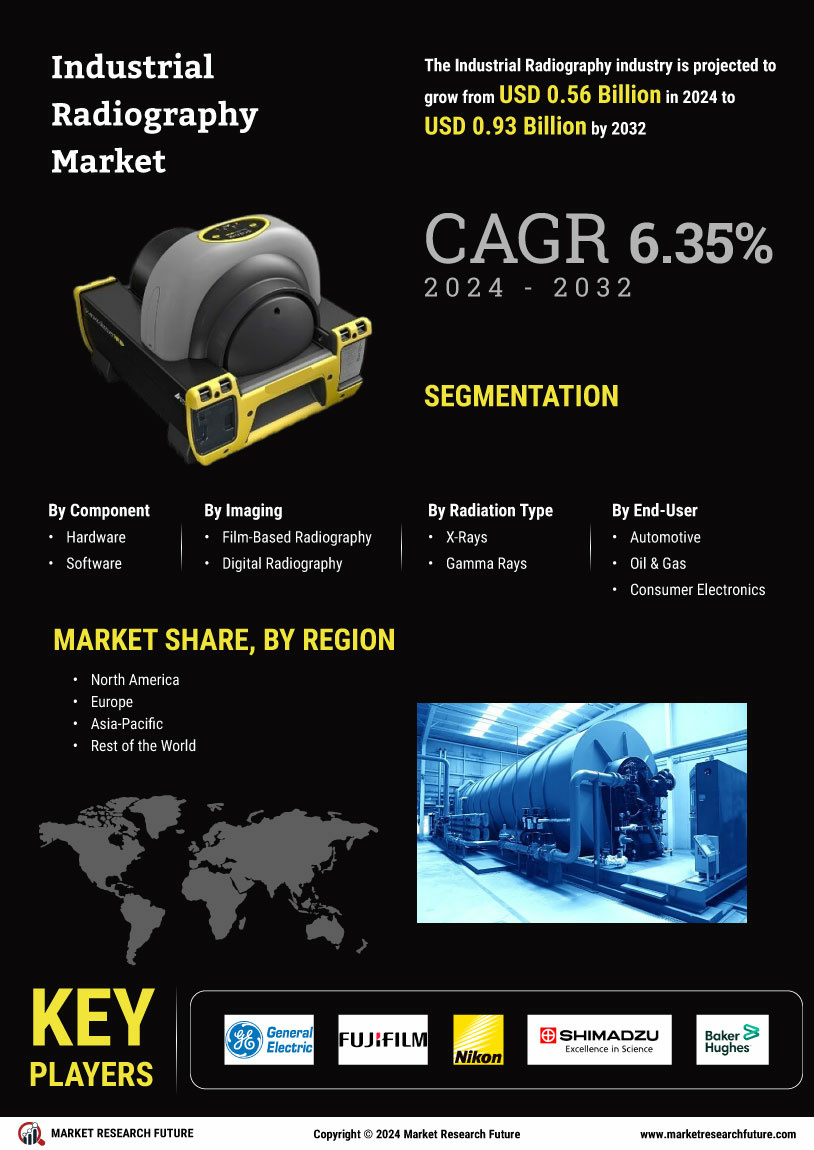

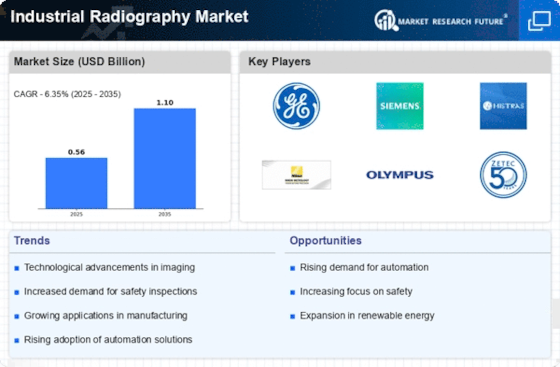

The Industrial Radiography Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as digital radiography and computed radiography are enhancing image quality and reducing exposure times. These technologies not only improve the efficiency of inspections but also ensure higher accuracy in detecting flaws in materials. The market for industrial radiography equipment is projected to grow significantly, with estimates suggesting a compound annual growth rate of around 6% over the next few years. This growth is driven by the increasing adoption of advanced imaging techniques across various sectors, including aerospace, automotive, and construction, where precision is paramount. As industries seek to enhance safety and compliance, the integration of cutting-edge technologies in the Industrial Radiography Market appears to be a key driver of growth.