Industrial Pump Market Summary

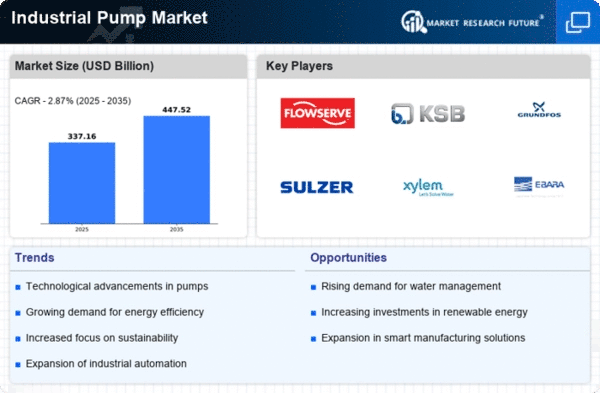

As per MRFR analysis, the Industrial Pump Market was estimated at 327.75 USD Billion in 2024. The Industrial Pump industry is projected to grow from 337.16 USD Billion in 2025 to 447.52 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 2.87% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Industrial Pump Market is poised for robust growth driven by technological advancements and increasing sustainability initiatives.

- Technological advancements are enhancing pump efficiency and reliability across various applications.

- Sustainability initiatives are prompting industries to adopt eco-friendly pumping solutions, particularly in North America.

- The water and wastewater treatment segment remains the largest, while the oil and gas segment is experiencing rapid growth in the Asia-Pacific region.

- Rising demand in water and wastewater management and the expansion of manufacturing industries are key drivers of market growth.

Market Size & Forecast

| 2024 Market Size | 327.75 (USD Billion) |

| 2035 Market Size | 447.52 (USD Billion) |

| CAGR (2025 - 2035) | 2.87% |

Major Players

Flowserve Corporation (US), KSB SE & Co. KGaA (DE), Grundfos Holding A/S (DK), Sulzer Ltd (CH), Xylem Inc. (US), Ebara Corporation (JP), Weir Group PLC (GB), Pentair PLC (IE), SPX Flow, Inc. (US)