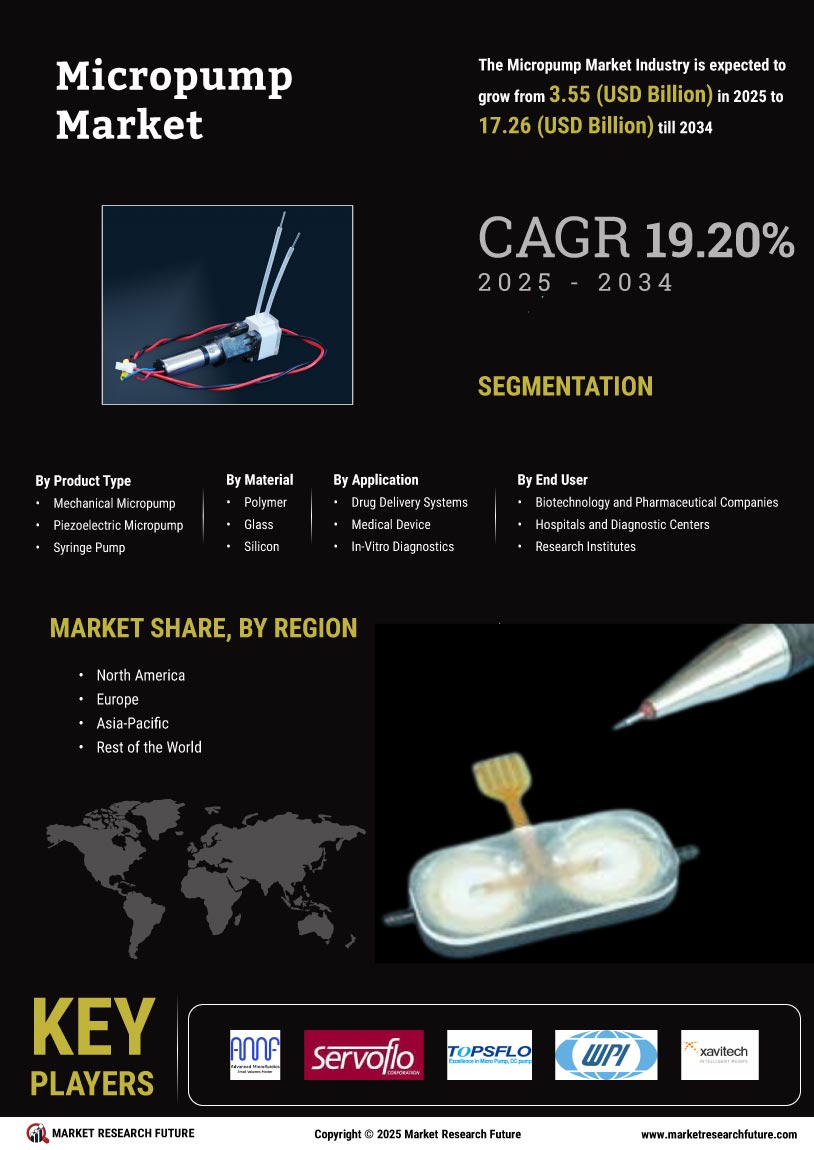

Market Growth Projections

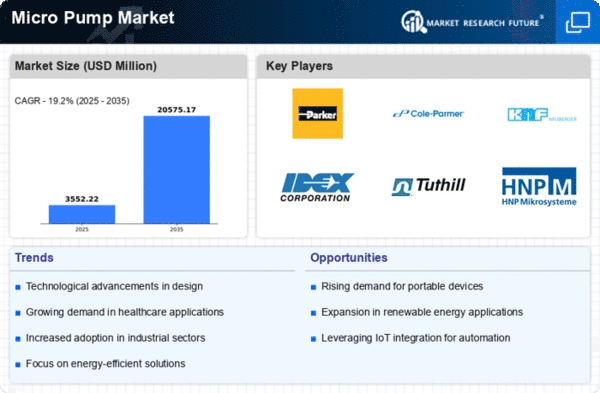

The Global Micropump Market Industry is characterized by robust growth projections, with the market expected to expand significantly over the next decade. The market is anticipated to grow from 2.98 USD Billion in 2024 to an impressive 20.6 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 19.2% from 2025 to 2035. Such projections indicate a strong demand for micropump technology across various sectors, driven by advancements in technology, increasing applications, and a focus on sustainability. This growth reflects the evolving landscape of the micropump industry and its critical role in addressing modern challenges.

Technological Advancements

The Global Micropump Market Industry is witnessing rapid technological advancements that enhance the efficiency and functionality of micropumps. Innovations in materials and design are leading to the development of more compact and energy-efficient devices. For instance, the integration of microelectromechanical systems (MEMS) technology is enabling the production of highly precise micropumps. These advancements are crucial as they cater to the increasing demand for miniaturized medical devices and lab-on-a-chip applications. As a result, the market is projected to grow from 2.98 USD Billion in 2024 to an estimated 20.6 USD Billion by 2035, reflecting a robust CAGR of 19.2% from 2025 to 2035.

Rising Demand in Healthcare

The Global Micropump Market Industry is significantly driven by the rising demand for advanced healthcare solutions. Micropumps play a pivotal role in drug delivery systems, enabling controlled and precise administration of medications. The increasing prevalence of chronic diseases necessitates innovative treatment methods, thereby propelling the adoption of micropumps in medical devices. For example, insulin delivery systems and wearable drug delivery devices are increasingly utilizing micropump technology. This trend is expected to contribute to the market's growth, with projections indicating a rise from 2.98 USD Billion in 2024 to 20.6 USD Billion by 2035, underscoring the critical role of micropumps in modern healthcare.

Emerging Markets and Global Expansion

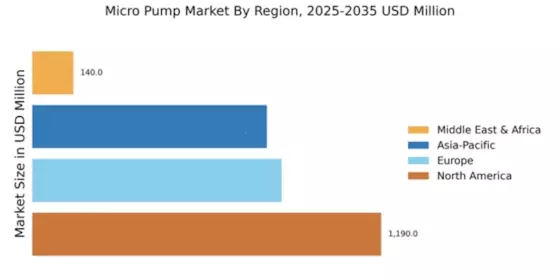

The Global Micropump Market Industry is poised for growth due to the emergence of new markets and global expansion efforts. Developing regions are increasingly investing in healthcare infrastructure and advanced manufacturing capabilities, creating opportunities for micropump adoption. Countries in Asia-Pacific and Latin America are particularly noteworthy, as they experience rapid industrialization and urbanization. This trend is likely to drive demand for micropumps in various applications, from healthcare to industrial processes. The market is projected to grow from 2.98 USD Billion in 2024 to 20.6 USD Billion by 2035, indicating the potential for significant expansion in these emerging markets.

Environmental Sustainability Initiatives

The Global Micropump Market Industry is also influenced by the growing emphasis on environmental sustainability. As industries strive to reduce their carbon footprint, micropumps offer a solution for efficient fluid management, minimizing waste and energy consumption. For example, micropumps are being integrated into renewable energy systems, such as solar water pumping, which aligns with global sustainability goals. The increasing regulatory pressure for eco-friendly practices is likely to boost the adoption of micropump technology. This shift towards sustainability is expected to contribute to the market's growth, with projections indicating a rise from 2.98 USD Billion in 2024 to 20.6 USD Billion by 2035, reflecting the industry's commitment to environmentally responsible solutions.

Growing Applications in Industrial Processes

The Global Micropump Market Industry is experiencing growth due to the expanding applications of micropumps in various industrial processes. Industries such as pharmaceuticals, chemicals, and food and beverage are increasingly adopting micropump technology for precise fluid handling and dosing. For instance, micropumps are utilized in automated laboratory systems for accurate reagent dispensing, enhancing operational efficiency. This trend is likely to drive market growth, as industries seek to optimize processes and reduce waste. The anticipated growth trajectory from 2.98 USD Billion in 2024 to 20.6 USD Billion by 2035 indicates the increasing reliance on micropumps across diverse sectors, highlighting their versatility and importance.