Regulatory Compliance

Regulatory compliance is a significant factor influencing the Industrial Personnel And Burden Carriers Electric Market. Governments worldwide are implementing stricter regulations regarding emissions and workplace safety, compelling companies to transition to electric solutions. Compliance with these regulations often necessitates the adoption of electric personnel and burden carriers, which are designed to meet stringent environmental standards. As a result, the market is likely to see an increase in demand for electric carriers that comply with these regulations, further propelling growth. The anticipated regulatory landscape suggests that companies will increasingly invest in electric solutions to avoid penalties and enhance their operational efficiency.

Sustainability Initiatives

Sustainability initiatives are becoming a pivotal driver in the Industrial Personnel And Burden Carriers Electric Market. With growing environmental concerns, companies are prioritizing electric carriers as a means to reduce their carbon footprint. The shift towards electric vehicles aligns with global efforts to promote cleaner energy sources and reduce greenhouse gas emissions. According to recent data, electric carriers can reduce emissions by up to 70% compared to traditional fossil fuel-powered vehicles. This commitment to sustainability not only enhances corporate responsibility but also meets the increasing demand from consumers for environmentally friendly products, thereby driving market growth.

Technological Advancements

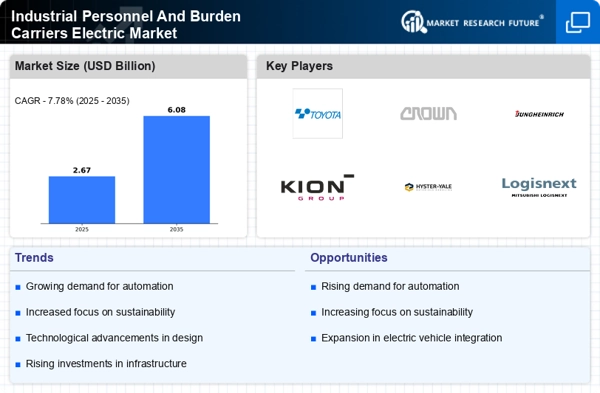

The Industrial Personnel And Burden Carriers Electric Market is experiencing a surge in technological advancements, particularly in automation and electric vehicle technology. Innovations such as improved battery efficiency and smart navigation systems are enhancing the operational capabilities of electric carriers. For instance, the integration of IoT devices allows for real-time monitoring and data analytics, which can optimize fleet management and reduce operational costs. As companies increasingly adopt these technologies, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. This trend indicates a strong shift towards more efficient and technologically integrated solutions in the industry.

Workplace Safety Enhancements

Workplace safety enhancements are increasingly driving the Industrial Personnel And Burden Carriers Electric Market. The demand for safer working environments has led to the adoption of electric carriers equipped with advanced safety features such as collision detection systems and ergonomic designs. These enhancements not only protect workers but also improve productivity by minimizing accidents and downtime. As organizations prioritize employee safety, the market for electric personnel and burden carriers is expected to expand. Recent studies indicate that companies investing in safety technologies can reduce workplace injuries by up to 30%, thereby reinforcing the importance of safety in driving market growth.

Increased Demand for Efficient Logistics

The increased demand for efficient logistics solutions is a key driver in the Industrial Personnel And Burden Carriers Electric Market. As e-commerce and supply chain operations expand, the need for effective material handling solutions becomes paramount. Electric personnel and burden carriers offer enhanced maneuverability and efficiency, making them ideal for warehouses and distribution centers. Market analysis suggests that the logistics sector is projected to grow significantly, with electric carriers playing a crucial role in meeting the rising demand for fast and reliable delivery services. This trend indicates a robust future for electric carriers as essential tools in modern logistics.