General Dynamics: General Dynamics is the manufacturer of the Stryker armored vehicle, which is one of the most widely used APCs in the world. The company is currently developing a new variant of the Stryker, called the Stryker Dragoon, which is equipped with a 30mm cannon and a launcher for ATGMs.

Rheinmetall: Rheinmetall is a German company that manufactures a wide range of military vehicles, including the Fuchs APC. The company recently announced that it is developing a new version of the Fuchs, which will be equipped with a number of new features, including an improved mine protection system and a new engine.

Hanwha Defense: Hanwha Defense is a South Korean company that manufactures the KIFV APC. The company recently announced that it is developing a new variant of the KIFV, which will be equipped with a number of new features, including an active protection system and a new remote weapon station.

Research Methodology

The market numbers and forecast derived were the outcome of our disciplined research methodology which includes secondary research, primary interviews, followed by data triangulation and validation from our in-house data repository and statistical modeling tools.

Secondary Research

In this process, the data collection was done through various secondary sources, which included annual reports, SEC filings, journals, government association, Aerospace & Defense magazines, white papers, corporate presentations, company websites, some paid databases and many others.

Primary Research

In this process, both demand side and supply side parties were involved to extract genuine facts and insights about market forecast, production, trend, and projected market growth. Industry stakeholders such as CEOs, VPs, directors, and marketing executives across the value chain have been approached to obtain key information.

Report Key Insights

- Market Sizing, Forecast and Analysis: Detailed coverage on market segment and its sub segments

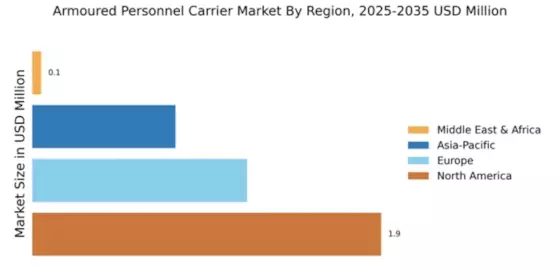

- Regional / Country Trend and Forecast: Detailed analysis on North America, Asia Pacific, Europe, Middle East & Africa, and Latin America, along with key countries in each of the regions

- Market dynamics intelligence: Market drivers, opportunities, trends, restraints, Porter’s five forces, supply chain & value chain analysis

- Technology Trend, Regulatory Landscape, and Patent Analysis Outlook

- Competitive Intelligence: Market share analysis, financial analysis, product benchmarking, strategic developments including JVs, Product Launch, and M&A

- Regional attractiveness and related growth opportunities

Report Customization

MRFR offers report customization to our valued customers. Below are the options available for customization:

Company Profiles

In-depth profiling of additional market players (3 to 4 companies)

Country Level Analysis

Detailed analysis of a country and its related segment as per the report scope (subject to data availability)