E-commerce Growth

The rapid expansion of e-commerce is reshaping the Industrial Packaging Market, as businesses seek packaging solutions that cater to online retail. The rise in online shopping has led to an increased demand for protective and efficient packaging that ensures products arrive safely at consumers' doorsteps. Data indicates that e-commerce sales have surged, with projections estimating that they will account for a significant portion of total retail sales in the near future. This trend necessitates the development of packaging that not only protects goods but also enhances the unboxing experience for consumers. As a result, companies are investing in innovative packaging designs and materials that meet the unique challenges posed by e-commerce logistics. The Industrial Packaging Market is thus adapting to these changes, focusing on solutions that facilitate seamless online transactions.

Consumer Preferences

Shifting consumer preferences are a driving force in the Industrial Packaging Market, as customers increasingly seek convenience, functionality, and sustainability in packaging. Modern consumers are more informed and discerning, often favoring brands that prioritize eco-friendly practices and innovative packaging solutions. This shift is prompting companies to rethink their packaging strategies, focusing on designs that enhance user experience while minimizing environmental impact. Market data suggests that consumers are willing to pay a premium for products that feature sustainable packaging, indicating a potential for increased profitability for businesses that align with these preferences. As consumer expectations continue to evolve, the Industrial Packaging Market must remain agile, adapting to the changing landscape to meet the demands of a more conscientious consumer base.

Regulatory Compliance

The Industrial Packaging Market is significantly influenced by stringent regulatory frameworks aimed at ensuring safety and environmental protection. Governments worldwide are implementing regulations that mandate specific packaging standards, particularly for hazardous materials and food products. Compliance with these regulations is not optional; it is essential for companies to avoid penalties and maintain market access. As a result, businesses are increasingly investing in packaging solutions that meet these regulatory requirements. This trend is expected to continue, with more regulations likely to emerge as environmental concerns gain prominence. Companies that proactively adapt to these changes are likely to gain a competitive edge in the Industrial Packaging Market, as they demonstrate their commitment to safety and sustainability.

Technological Innovations

Technological advancements are playing a pivotal role in transforming the Industrial Packaging Market. Innovations such as automation, smart packaging, and advanced materials are enhancing efficiency and reducing costs. For instance, the integration of IoT technology in packaging allows for real-time tracking and monitoring of products throughout the supply chain. This not only improves inventory management but also enhances transparency and traceability, which are increasingly demanded by consumers and regulators alike. Furthermore, advancements in materials science are leading to the development of lighter, stronger, and more sustainable packaging options. As these technologies continue to evolve, they are likely to drive significant changes in the Industrial Packaging Market, enabling companies to optimize their operations and meet the growing expectations of their customers.

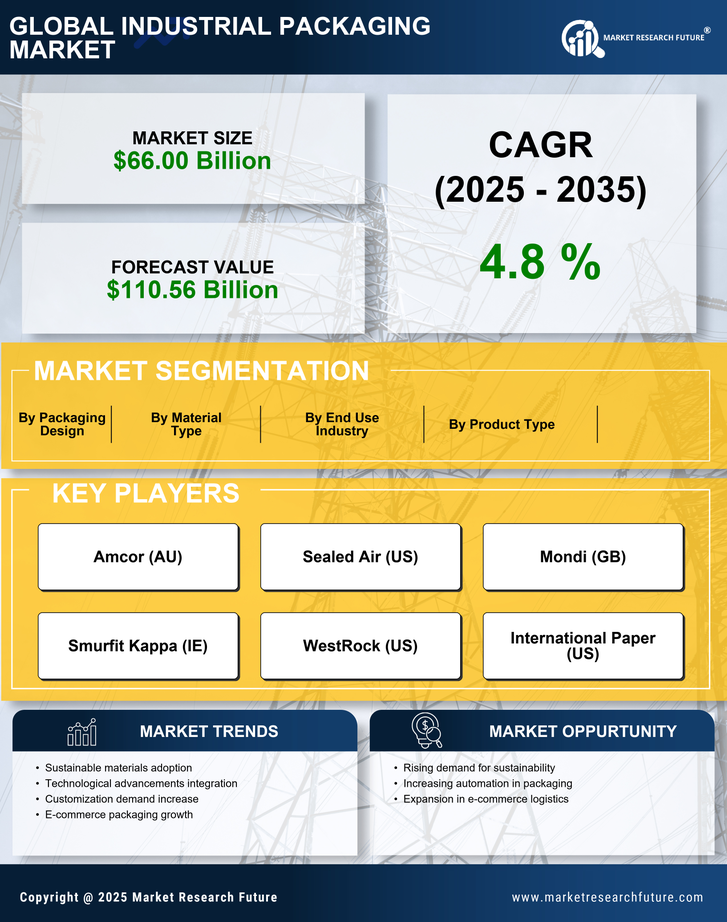

Sustainability Initiatives

The increasing emphasis on sustainability within the Industrial Packaging Market is driving demand for eco-friendly packaging solutions. Companies are increasingly adopting biodegradable and recyclable materials to meet regulatory requirements and consumer preferences. This shift is not merely a trend; it reflects a broader commitment to reducing environmental impact. According to recent data, the market for sustainable packaging is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is indicative of a larger movement towards responsible consumption and production practices, which are becoming essential for businesses aiming to enhance their brand image and customer loyalty. As sustainability becomes a core value, the Industrial Packaging Market is likely to see a surge in innovative packaging solutions that align with these principles.