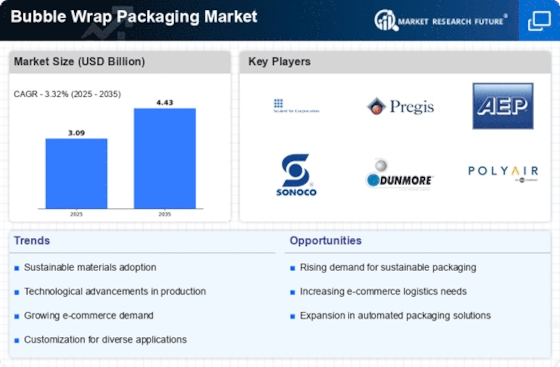

Increased Focus on Sustainability

The Bubble Wrap Packaging Market is witnessing a shift towards sustainability, as businesses and consumers alike prioritize eco-friendly packaging solutions. With growing awareness of environmental issues, companies are exploring alternatives to traditional plastic bubble wrap. This has led to the emergence of biodegradable and recyclable bubble wrap options, which cater to the demand for sustainable packaging. In 2025, the market for sustainable packaging is projected to reach 400 billion USD, indicating a significant opportunity for the Bubble Wrap Packaging Market to adapt and innovate. By investing in sustainable materials and practices, manufacturers can not only meet regulatory requirements but also enhance their brand image and appeal to environmentally conscious consumers.

Growth of E-commerce and Online Retail

The Bubble Wrap Packaging Market is significantly influenced by the rapid growth of e-commerce and online retail platforms. As more consumers opt for online shopping, the need for reliable packaging solutions to ensure safe delivery of products intensifies. In 2025, e-commerce sales are expected to surpass 5 trillion USD, creating a substantial demand for effective packaging materials. Bubble wrap, known for its cushioning properties, is increasingly utilized by e-commerce businesses to protect fragile items during shipping. This trend not only enhances customer satisfaction but also reduces return rates due to damaged goods. Consequently, the Bubble Wrap Packaging Market is poised to benefit from this surge in online retail, as companies prioritize packaging solutions that safeguard their products throughout the delivery process.

Rising Demand for Protective Packaging

The Bubble Wrap Packaging Market experiences a notable increase in demand for protective packaging solutions. This trend is primarily driven by the expansion of various sectors, including electronics, pharmaceuticals, and consumer goods. As companies seek to minimize product damage during transit, the need for effective cushioning materials becomes paramount. In 2025, the market for protective packaging is projected to reach approximately 30 billion USD, indicating a robust growth trajectory. The Bubble Wrap Packaging Market plays a crucial role in fulfilling this demand, as its lightweight and flexible nature offers superior protection against shocks and vibrations. Furthermore, the increasing focus on product integrity and customer satisfaction propels manufacturers to invest in high-quality bubble wrap solutions, thereby enhancing the overall market landscape.

Technological Innovations in Packaging

Technological advancements are reshaping the Bubble Wrap Packaging Market, leading to the development of innovative packaging solutions. Manufacturers are increasingly adopting automation and smart technologies to enhance production efficiency and product quality. For instance, the integration of advanced materials and manufacturing techniques allows for the creation of bubble wrap that is lighter yet more effective in cushioning. Additionally, the introduction of biodegradable and recyclable bubble wrap options aligns with sustainability goals, appealing to environmentally conscious consumers. As the packaging industry evolves, these technological innovations are expected to drive growth in the Bubble Wrap Packaging Market, as companies seek to differentiate their products and meet changing consumer preferences.

Expansion of the Logistics and Transportation Sector

The Bubble Wrap Packaging Market is positively impacted by the expansion of the logistics and transportation sector. As global trade continues to grow, the need for efficient and reliable packaging solutions becomes increasingly critical. The logistics industry, valued at over 8 trillion USD in 2025, relies heavily on protective packaging to ensure that goods are transported safely and efficiently. Bubble wrap serves as an essential component in this process, providing cushioning and protection for a wide range of products. The increasing complexity of supply chains and the demand for faster delivery times further emphasize the importance of effective packaging solutions. Consequently, the Bubble Wrap Packaging Market is likely to experience growth as logistics companies seek to enhance their packaging strategies to meet evolving consumer expectations.