Industrial Packaging Size

Market Size Snapshot

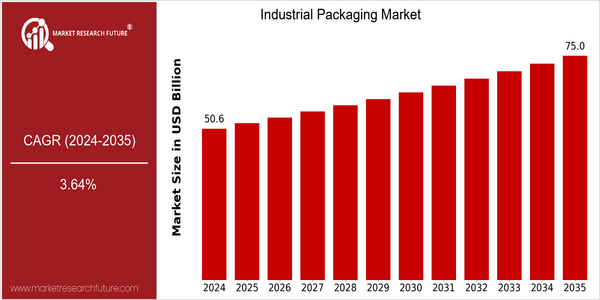

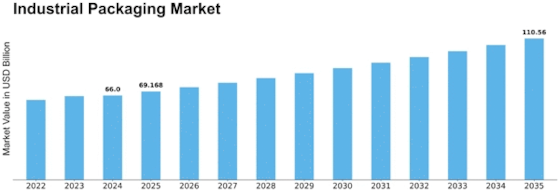

| Year | Value |

|---|---|

| 2024 | USD 50.58 Billion |

| 2035 | USD 75.0 Billion |

| CAGR (2025-2035) | 3.64 % |

Note – Market size depicts the revenue generated over the financial year

The world industrial packaging market is a market with great potential. Its current size is $ 50.58 billion in 2024, and it will reach $ 75 billion in 2035. CAGR of 3.64% from 2025 to 2035. The market will be driven by several factors, including the increasing demand for sustainable packaging solutions, the development of packaging technology, and the need for efficient logistics and supply chains. The shift to biodegradable and recyclable materials has become a major growth driver for the market. In addition, smart packaging and automation in the production process will increase operational efficiency and product safety, driving market demand. The major players in the industrial packaging market, such as Sealed Air, Amcor, and Smurfit Kappa, are actively involved in strategic cooperation, R & D and product launches to seize emerging market opportunities. These efforts not only enhance their market position, but also promote the overall development of the industrial packaging industry.

Regional Market Size

Regional Deep Dive

The Industrial Packing Market is growing at a fast pace in all regions, driven by the increasing demand for efficient and sustainable packaging solutions. In North America, the market is characterized by advanced manufacturing and innovation, while in Europe it is characterized by compliance with regulations and sustainability. In the Asia-Pacific region, industrialization and urbanization are booming, resulting in higher demand for packaging solutions. Middle East and Africa is characterized by growth in the manufacturing industry and increased infrastructure development, while Latin America focuses on improving supply chain efficiencies. Each region has its own unique trends and opportunities.

Europe

- The European Union's stringent regulations on plastic waste are driving innovation in biodegradable and recyclable packaging materials, with companies like Smurfit Kappa and Mondi leading the charge.

- There is a growing trend towards circular economy practices, with initiatives such as the European Green Deal promoting sustainable packaging solutions across various industries.

Asia Pacific

- Rapid urbanization in countries like China and India is increasing the demand for industrial packaging, with local companies such as Huhtamaki and Amcor expanding their operations to meet this need.

- Innovations in smart packaging technologies are emerging, with companies investing in IoT-enabled packaging solutions to enhance supply chain transparency and efficiency.

Latin America

- The rise of local manufacturing and export activities in countries like Brazil and Mexico is driving demand for efficient industrial packaging solutions, with companies like Grupo Gondi expanding their product offerings.

- Sustainability is becoming a key focus, with initiatives aimed at reducing plastic waste and promoting recyclable materials gaining traction among manufacturers.

North America

- The rise of e-commerce has led to increased demand for industrial packaging solutions, with companies like Amazon investing heavily in packaging innovations to enhance supply chain efficiency.

- Regulatory changes, particularly in the food and pharmaceutical sectors, are pushing manufacturers to adopt more sustainable packaging materials, with organizations like the Sustainable Packaging Coalition leading initiatives in this area.

Middle East And Africa

- The region is witnessing significant investments in infrastructure, particularly in the UAE and Saudi Arabia, which is boosting the demand for industrial packaging solutions in construction and manufacturing sectors.

- Government initiatives aimed at diversifying economies away from oil dependency are encouraging the growth of the manufacturing sector, leading to increased demand for industrial packaging.

Did You Know?

“Approximately 30% of all packaging produced globally is used for industrial purposes, highlighting the critical role of industrial packaging in supply chain efficiency.” — Smithers Pira

Segmental Market Size

The industrial packaging segment is an important part of the overall market, and it is currently experiencing stable growth, mainly because of the increasing demand for efficient and sustainable packaging solutions. This demand is driven by the need for greater product safety during transport and storage, as well as by the growing importance of regulations that are designed to reduce the impact of packaging on the environment. In order to meet these regulations and the consumers’ expectations, companies are increasingly adopting eco-friendly materials and methods. The industrial packaging segment is now in its maturity phase, and the world’s largest companies, such as Amcor and Sealed Air, are able to offer advanced packaging solutions across a wide range of industries. Food and beverage, pharmaceuticals and chemicals are the most important areas of application, where sustainable and protective packaging is essential. This trend towards more sustainable packaging, as well as the focus on waste reduction, is further accelerating the growth of this market. Also, smart packaging and biodegradable materials are changing the way we think about packaging, helping companies to reduce their carbon footprint and make their products more visible.

Future Outlook

The industrial packaging market will grow at a steady rate from 2024 to 2035, with a projected rise from USD 50.58 billion to USD 75.0 billion, at a compound annual growth rate of 3.64%. This is largely due to the growing demand for sustainable packaging solutions, which is driven by stricter government regulations and a greater public awareness of the importance of sustainability. By 2030, biodegradable and recyclable packaging is expected to account for nearly 30% of the market. As the demand for sustainable packaging increases, the industry will shift towards a more sustainable way of doing business. The evolution of the industry will also be shaped by technological developments. Smart packaging, which uses IoT technology to track and monitor the transportation of goods, will become more popular. This will help to improve supply chain efficiency and product safety. In addition, the integration of automation into the packaging process will increase the productivity and efficiency of the industry. The demand for high-quality, efficient packaging will continue to grow as industries such as food and beverage, pharmaceuticals, and e-commerce continue to expand.

Leave a Comment