Growth in Food and Beverage Sector

The food and beverage sector is a significant driver of the flexible industrial packaging market. With the increasing demand for convenience foods and ready-to-eat meals, manufacturers are seeking packaging solutions that extend shelf life and maintain product freshness. Flexible packaging materials, such as pouches and films, are increasingly utilized due to their ability to provide barrier properties against moisture and oxygen. In 2025, the food and beverage industry is expected to represent a considerable share of the overall packaging market, with flexible solutions being preferred for their lightweight and space-saving characteristics. This growth underscores the importance of flexible industrial packaging in meeting the evolving needs of consumers.

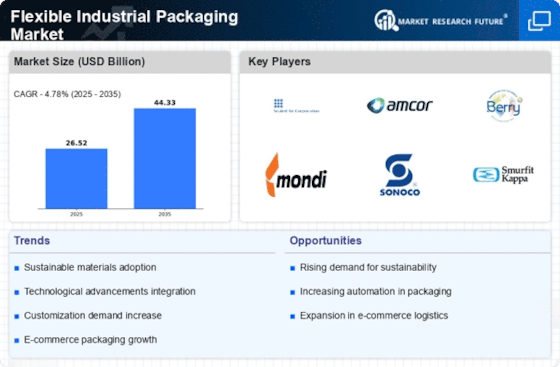

Advancements in Packaging Technology

Technological advancements in packaging materials and processes are significantly influencing the flexible industrial packaging market. Innovations such as biodegradable films, smart packaging, and enhanced barrier technologies are emerging, allowing manufacturers to create more efficient and sustainable packaging solutions. These advancements not only improve product protection but also cater to the growing consumer demand for environmentally friendly options. In 2025, the market is likely to see an increase in the adoption of these technologies, as companies strive to differentiate their products and enhance brand value. This trend suggests a dynamic shift towards more sophisticated flexible industrial packaging solutions.

Rising Demand for E-commerce Packaging

The surge in e-commerce activities has led to an increased demand for flexible industrial packaging solutions. As online shopping continues to expand, businesses require packaging that is lightweight, durable, and cost-effective. Flexible industrial packaging market is witnessing a shift towards materials that can withstand the rigors of transportation while ensuring product safety. In 2025, the e-commerce sector is projected to account for a substantial portion of the packaging market, with flexible solutions being favored for their efficiency. This trend indicates a growing preference for packaging that not only protects products but also enhances the consumer experience, thereby driving the flexible industrial packaging market.

Customization Trends in Packaging Solutions

The trend towards customization in packaging solutions is becoming a prominent driver in the flexible industrial packaging market. Businesses are increasingly seeking tailored packaging that meets specific product requirements and enhances brand identity. This demand for customization is leading to innovations in design and materials, allowing for unique packaging solutions that stand out in the marketplace. In 2025, the flexible industrial packaging market is expected to see a rise in personalized packaging options, as companies recognize the value of creating a distinctive consumer experience. This trend highlights the importance of flexibility and adaptability in packaging strategies.

Regulatory Support for Sustainable Practices

Regulatory frameworks promoting sustainability are increasingly impacting the flexible industrial packaging market. Governments are implementing policies aimed at reducing plastic waste and encouraging the use of recyclable materials. This regulatory support is driving manufacturers to innovate and adopt sustainable packaging solutions. In 2025, it is anticipated that compliance with these regulations will become a critical factor for businesses, influencing their packaging choices. The flexible industrial packaging market is likely to benefit from this shift, as companies seek to align with sustainability goals while meeting consumer expectations for eco-friendly products. This trend indicates a potential transformation in packaging practices.