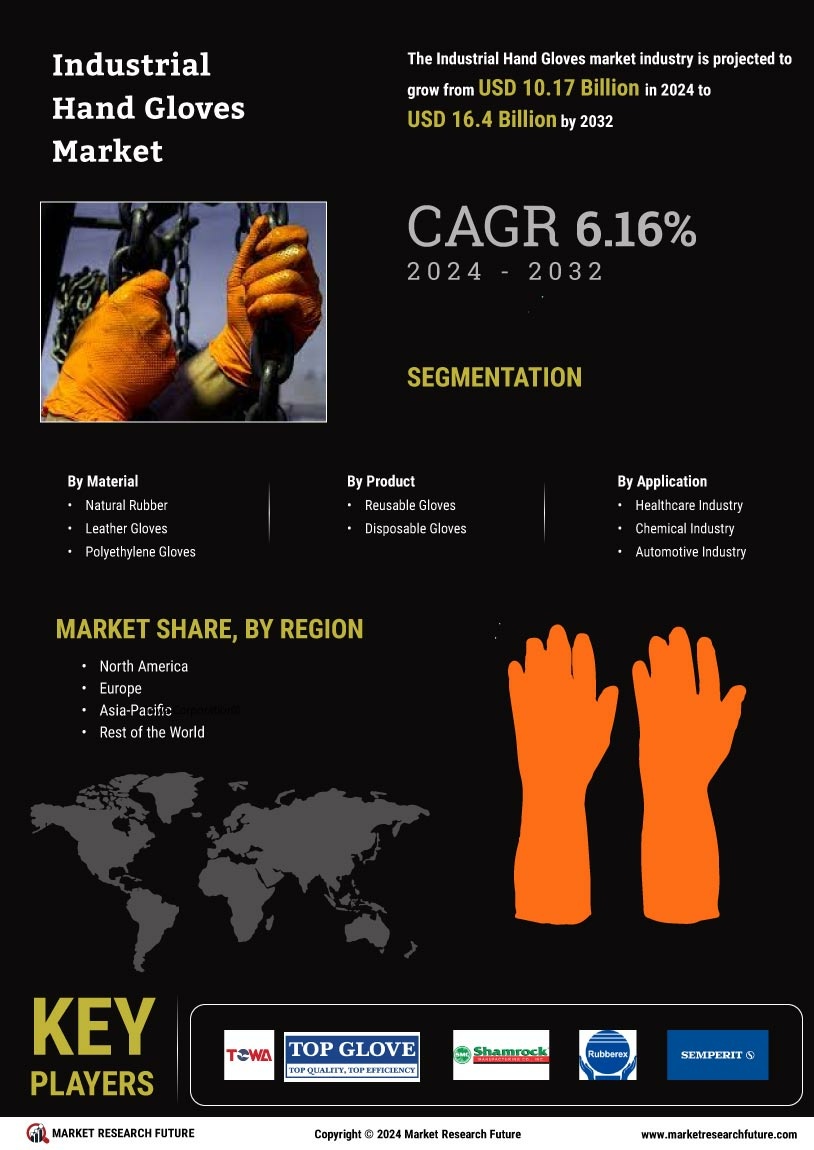

Market Trends and Projections

The Industrial Hand Gloves Market is projected to experience substantial growth in the coming years. The market is expected to reach a value of 10.2 USD Billion in 2024 and is anticipated to grow to 19.6 USD Billion by 2035, reflecting a robust CAGR of 6.16% from 2025 to 2035. This growth trajectory indicates a strong demand for various types of gloves, driven by factors such as increased industrial activities, safety regulations, and technological advancements. The market's expansion is likely to create opportunities for manufacturers to innovate and cater to the evolving needs of diverse industries.

Growth of the Manufacturing Sector

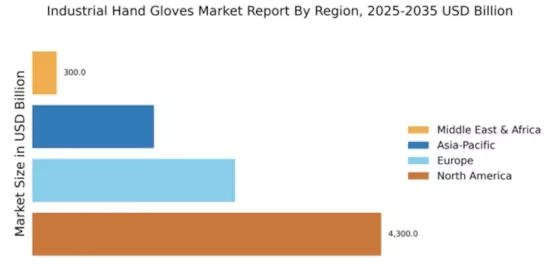

The expansion of the manufacturing sector is a crucial driver for the Industrial Hand Gloves Industry. As countries focus on boosting their manufacturing capabilities, the demand for protective gear, including hand gloves, is likely to increase. For instance, in regions like Asia-Pacific, rapid industrialization and urbanization are contributing to heightened safety awareness among employers. This trend is expected to propel the market value to approximately 19.6 USD Billion by 2035. The manufacturing sector's growth necessitates the use of protective equipment to ensure worker safety, thereby driving the demand for industrial hand gloves.

Rising Industrial Safety Regulations

The Industrial Hand Gloves Market is experiencing growth due to increasing safety regulations across various sectors. Governments worldwide are implementing stringent safety standards to protect workers from occupational hazards. For instance, the Occupational Safety and Health Administration (OSHA) in the United States mandates the use of protective gloves in industries such as construction and manufacturing. This regulatory push is likely to drive demand for high-quality hand protection solutions, contributing to the market's projected value of 10.2 USD Billion in 2024. As industries adapt to these regulations, the need for compliant and effective hand protection will continue to rise.

Diverse Applications Across Industries

The versatility of industrial hand gloves across various applications is a significant factor driving the Global Industrial Hand Gloves Industry. Gloves are utilized in a wide range of sectors, including healthcare, food service, automotive, and construction. Each industry has unique requirements for hand protection, leading to a diverse product offering. For instance, disposable gloves are essential in healthcare settings for hygiene, while heavy-duty gloves are preferred in construction for durability. This diversity in applications ensures a steady demand for industrial hand gloves, contributing to the overall market growth.

Increased Awareness of Workplace Safety

There is a growing awareness of workplace safety among employers and employees, which is positively impacting the Industrial Hand Gloves Industry. Organizations are increasingly recognizing the importance of providing adequate protective equipment to minimize workplace injuries. This heightened awareness is leading to more investments in safety training and equipment procurement. For example, industries such as construction and logistics are prioritizing hand protection to reduce the risk of injuries. As a result, the market is likely to see sustained growth, driven by the collective efforts of companies to foster a safer working environment for their employees.

Technological Advancements in Materials

Innovations in materials science are significantly influencing the Industrial Hand Gloves Market. The introduction of advanced materials such as nitrile, latex gloves, and polyethylene is enhancing glove performance in terms of durability, flexibility, and chemical resistance. These advancements allow gloves to meet the diverse needs of various industries, including automotive, healthcare, and food processing. For example, gloves made from nitrile provide superior puncture resistance, making them ideal for hazardous environments. As these technologies evolve, the market is expected to expand, with a projected CAGR of 6.16% from 2025 to 2035, reflecting the growing demand for specialized hand protection.