Research Methodology on Industrial Films Market

Introduction:

The emergence of new technologies and the widespread use of industrial films has been accompanied by increased demand from various industries, leading to the emergence of a new market for industrial films. Industrial films are defined as thin layers of plastic with a certain thickness and width, used in various industrial and commercial applications. The goal of the industrial film is to address a variety of needs including the protection and storage of various products and to ensure the flow of material. This market has witnessed several advancements and sweeping changes over the past decade, resulting in its inclusion as a key component in various industries.

The purpose of this research is to provide an in-depth analysis and an outlook of the industrial films market on a global basis, covering the drivers, restraints, opportunities and growth potential. Additionally, a thorough analysis of the recent trends in new technologies, and geographic regions are presented. To provide a comprehensive and exhaustive outlook of the industrial films market, the data is sourced from a variety of sources such as Frost & Sullivan, Allied Market Research, Markets and Markets, and other press releases.

Research Methodology:

This report is based on a detailed qualitative and overall market research approach that is going to encompass the secondary and primary research approaches. The industrial films market can be studied, categorized and segmented based on various products and applications. The scope of the market is limited to the major products and key application regions.

Secondary Research:

Secondary research is the first and foremost approach that shall be employed to access the accurate information and data needed to conduct a thorough evaluation of the industrial film market. The data is collected and analyzed through a comprehensive search of key databases, journals and other pertinent industry publications such as Frost & Sullivan, Allied Market Research, Markets and Markets, and other press releases.

Primary Research:

Primary research is conducted to gain an in-depth understanding of the industrial films market and its associated areas, such as the industry trends, the supplier and competitor landscapes, and other areas. The primary research is conducted through telephone and personal interviews, with industry experts from both suppliers and manufacturers, and with other key stakeholders in the industrial films market.

The primary research is conducted to gain an in-depth understanding of the industrial films market, specific to each geographic region, Application and product type/usage.

Data Collection and Analysis:

The data collected through both primary and secondary research is conducted systematically and logically, to obtain the most accurate and relevant information. The data is then analyzed and the relevant facts and figures are used to form the basis of the report.

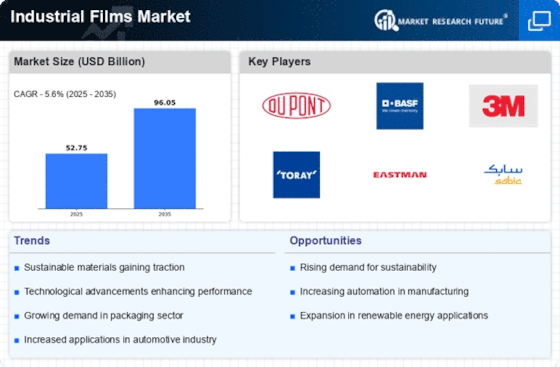

Research Findings:

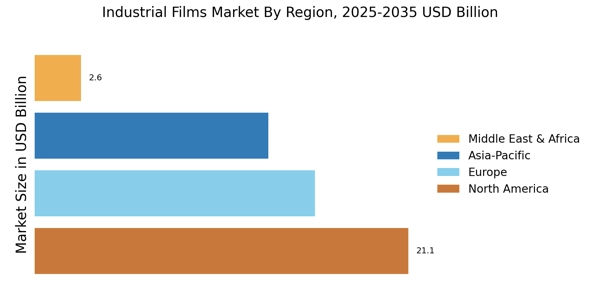

The research findings provide an in-depth understanding of the industrial films market and its associated areas, such as the trends and key players, as well as future outlook. The report also provides a segmentation of the market by key regions, product type/usage, and application.

Conclusion:

The analysis and research conducted for this report provide a thorough understanding of the industrial films market, along with its various opportunities and competitive landscape. The report also outlines the key trends and market drivers to provide insight into how the industrial film market will progress.