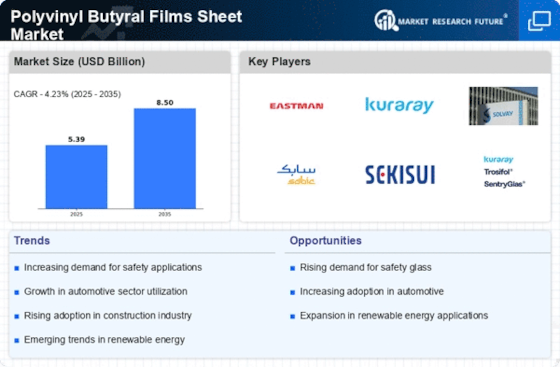

Rising Demand for Laminated Glass

The Polyvinyl Butyral Films Sheet Market is witnessing a surge in demand for laminated glass products across various sectors. Laminated glass, which incorporates polyvinyl butyral films, is favored for its safety, sound insulation, and UV protection properties. The architectural and automotive industries are primary consumers of laminated glass, with the market for laminated glass expected to grow at a rate of approximately 6% annually. This growth is attributed to the increasing preference for high-performance glass solutions that enhance aesthetic appeal while ensuring safety. Additionally, the trend towards energy-efficient buildings is likely to further drive the demand for laminated glass, as it contributes to better thermal insulation. Consequently, the Polyvinyl Butyral Films Sheet Market stands to benefit from these evolving consumer preferences and regulatory requirements.

Expansion of Renewable Energy Sector

The Polyvinyl Butyral Films Sheet Market is likely to benefit from the expansion of the renewable energy sector, particularly in solar energy applications. Polyvinyl butyral films are utilized in the production of solar panels, where they serve as encapsulants that protect photovoltaic cells from environmental damage. As the global push for renewable energy sources intensifies, the demand for solar panels is expected to rise significantly, potentially increasing the need for polyvinyl butyral films. The renewable energy market is projected to grow at a compound annual growth rate of over 8% in the coming years, indicating a robust opportunity for the Polyvinyl Butyral Films Sheet Market. This trend underscores the potential for polyvinyl butyral films to play a crucial role in supporting sustainable energy solutions.

Growth in Automotive Safety Standards

The Polyvinyl Butyral Films Sheet Market is significantly influenced by the stringent safety regulations in the automotive sector. As manufacturers strive to meet these standards, the demand for laminated safety glass, which incorporates polyvinyl butyral films, is on the rise. The automotive industry is projected to grow at a compound annual growth rate of around 4% over the next few years, further driving the need for advanced safety features. Polyvinyl butyral films enhance the structural integrity of automotive glass, providing better impact resistance and reducing the risk of shattering. This trend is likely to continue as consumer awareness regarding vehicle safety increases, thereby propelling the Polyvinyl Butyral Films Sheet Market forward. The integration of these films in electric and autonomous vehicles may also present new opportunities for market growth.

Increasing Use in Construction Applications

The Polyvinyl Butyral Films Sheet Market is experiencing a notable increase in demand due to its applications in the construction sector. These films are utilized in laminated glass for buildings, providing safety and sound insulation. The construction industry has seen a resurgence, with investments in infrastructure projects leading to a projected growth rate of approximately 5% annually. This trend indicates a robust market for polyvinyl butyral films, as they enhance the durability and safety of glass products used in modern architecture. Furthermore, the emphasis on energy-efficient buildings is likely to bolster the demand for these films, as they contribute to improved thermal performance. As urbanization continues to rise, the Polyvinyl Butyral Films Sheet Market is poised for expansion, driven by the need for innovative building materials.

Technological Innovations in Film Production

The Polyvinyl Butyral Films Sheet Market is being propelled by advancements in film production technologies. Innovations such as improved manufacturing processes and enhanced film formulations are leading to higher quality products that meet diverse application needs. These technological advancements are likely to reduce production costs and improve the performance characteristics of polyvinyl butyral films, making them more attractive to end-users. As manufacturers adopt these new technologies, the Polyvinyl Butyral Films Sheet Market may experience increased competition, driving further innovation and product development. The introduction of specialty films designed for specific applications, such as automotive or architectural uses, could also expand market opportunities. This dynamic environment suggests that the industry is on the cusp of significant transformation, driven by continuous improvement in production capabilities.