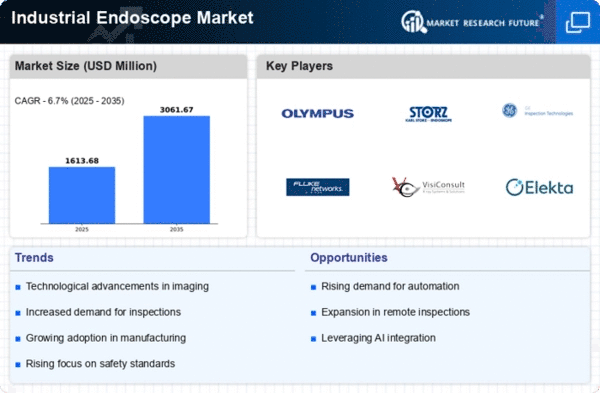

Market Growth Projections

The Global Industrial Endoscope Market Industry is projected to experience substantial growth over the coming years. With a market value expected to reach 1500 USD Million in 2024 and potentially expanding to 3500 USD Million by 2035, the industry is poised for significant development. The compound annual growth rate of 8.01% from 2025 to 2035 indicates a robust demand for industrial endoscopes across various sectors. This growth is driven by technological advancements, increasing awareness of inspection technologies, and the necessity for compliance with safety standards.

Technological Advancements

The Global Industrial Endoscope Market Industry is experiencing rapid technological advancements that enhance inspection capabilities. Innovations such as high-definition imaging, flexible articulation, and wireless connectivity are transforming the way inspections are conducted. For instance, the introduction of 4K resolution endoscopes allows for clearer visuals, enabling technicians to identify issues with greater precision. These advancements not only improve efficiency but also reduce downtime in various industrial sectors. As a result, the market is projected to reach 1500 USD Million in 2024, reflecting a growing demand for sophisticated inspection tools.

Expansion of End-User Industries

The Global Industrial Endoscope Market Industry is benefiting from the expansion of end-user industries such as aerospace, automotive, and energy. These sectors increasingly rely on endoscopes for internal inspections of complex machinery and components. For instance, in aerospace, endoscopes are utilized to inspect turbine engines, ensuring safety and compliance with stringent regulations. As these industries continue to grow, the demand for reliable inspection tools is expected to rise, further propelling the market. The integration of industrial endoscopes into standard operating procedures is likely to enhance operational efficiency and safety.

Rising Demand for Preventive Maintenance

Preventive maintenance is becoming increasingly critical across industries, driving growth in the Global Industrial Endoscope Market Industry. Companies are recognizing the importance of regular inspections to avoid costly downtimes and repairs. For example, in the manufacturing sector, routine checks using industrial endoscopes can identify wear and tear before they lead to equipment failure. This proactive approach is expected to contribute to the market's expansion, with projections indicating a growth to 3500 USD Million by 2035. The emphasis on maintenance strategies is likely to sustain a compound annual growth rate of 8.01% from 2025 to 2035.

Regulatory Compliance and Safety Standards

Stringent regulatory compliance and safety standards are pivotal drivers of the Global Industrial Endoscope Market Industry. Industries such as oil and gas, pharmaceuticals, and food processing are subject to rigorous inspections to meet safety and quality regulations. The use of industrial endoscopes facilitates compliance by enabling thorough internal inspections without disassembly. This capability not only ensures adherence to regulations but also enhances product quality and safety. As regulatory frameworks evolve, the demand for advanced inspection technologies is expected to grow, reinforcing the market's trajectory.

Growing Awareness of Inspection Technologies

There is a growing awareness of the benefits of inspection technologies within various industries, which is positively influencing the Global Industrial Endoscope Market Industry. Companies are increasingly recognizing that utilizing industrial endoscopes can lead to cost savings, improved safety, and enhanced operational efficiency. Educational initiatives and industry conferences are promoting the advantages of these technologies, leading to wider adoption. As awareness continues to spread, the market is likely to see increased investments in inspection tools, contributing to its overall growth.