Market Trends

Key Emerging Trends in the Industrial Endoscope Market

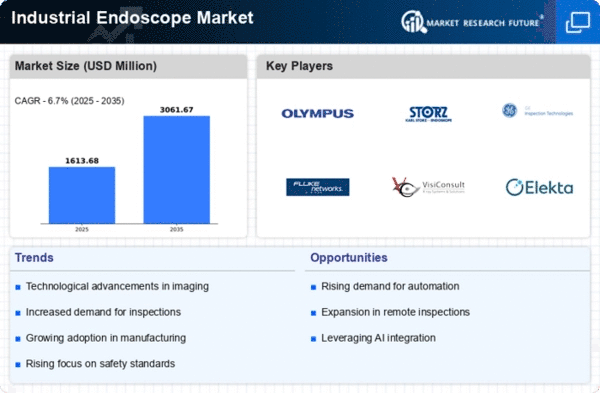

The industrial endoscope market is witnessing noteworthy trends that reflect advancements in technology, safety measures, and diverse applications across industries. These trends underscore the evolving landscape of industrial inspections and the growing importance of endoscopic tools in ensuring the integrity and reliability of critical systems.

One prominent trend in the industrial endoscope market is the continuous evolution of camera technology. High-definition cameras with enhanced image quality and increased pixel resolution have become standard features in modern industrial endoscopes. This trend not only facilitates clearer and more detailed inspections but also enables inspectors to identify potential issues with greater accuracy. The integration of advanced camera technology empowers inspectors to capture precise images, leading to more informed decision-making in maintenance and repair processes.

Another notable trend is the miniaturization of industrial endoscopes. As technology advances, endoscopic devices are becoming more compact and portable, allowing for easier maneuverability in confined spaces. The miniaturization trend aligns with the increasing demand for versatility in industrial inspections, enabling inspectors to access complex structures and systems with greater ease. This trend is particularly beneficial in industries such as aerospace, automotive, and manufacturing, where intricate components and tight spaces are common.

Wireless connectivity has emerged as a key trend in the industrial endoscope market. Many modern endoscopic devices now feature wireless capabilities, enabling real-time streaming of inspection footage to external devices such as smartphones or tablets. This wireless connectivity not only enhances flexibility during inspections but also promotes collaboration among inspection teams. Inspectors can share live footage with colleagues or supervisors, fostering more efficient decision-making processes.

Artificial intelligence (AI) integration is gaining momentum as a significant trend in industrial endoscope technology. AI algorithms are increasingly being incorporated into endoscopic systems to assist inspectors in analyzing captured images and identifying potential anomalies. This trend enhances the efficiency of inspections by automating certain aspects of the analysis process, allowing inspectors to focus on more complex decision-making tasks. AI-driven industrial endoscopes contribute to a faster and more accurate identification of issues, leading to proactive maintenance measures.

Furthermore, advancements in materials used in industrial endoscope construction are contributing to increased durability and resilience. The integration of robust materials ensures that endoscopes can withstand harsh environmental conditions and repetitive usage without compromising performance. This trend is particularly relevant in industries where inspections occur in challenging environments, such as oil and gas, petrochemicals, and construction.

The trend of enhanced software functionalities is also shaping the industrial endoscope market. Modern endoscopic systems often come equipped with sophisticated software that provides features such as image enhancement, measurement tools, and documentation capabilities. These software enhancements not only improve the overall inspection process but also contribute to comprehensive and accurate reporting. The integration of user-friendly software interfaces ensures that inspectors can navigate through inspection data efficiently.

Lastly, increased awareness of the importance of preventive maintenance is driving the adoption of industrial endoscopes across various industries. Companies are recognizing the value of regular inspections in identifying potential issues before they escalate, leading to unplanned downtime or critical failures. This trend aligns with a shift toward a proactive approach to maintenance, emphasizing the role of industrial endoscopes in predictive and preventive strategies.

The industrial endoscope market is witnessing transformative trends driven by technological advancements, increased emphasis on safety, and a broader understanding of the benefits of proactive maintenance. These trends collectively contribute to the market's evolution, ensuring that industrial endoscopes remain indispensable tools in maintaining the integrity and reliability of critical infrastructure across diverse industries.

Leave a Comment