Expansion of Industrial Sectors

The expansion of various industrial sectors is significantly influencing the Industrial Denox Systems Service Market. As manufacturing, power generation, and transportation sectors grow, the need for effective emission control systems becomes more pronounced. This expansion is accompanied by an increase in regulatory scrutiny, compelling industries to invest in Denox systems to mitigate their environmental impact. Recent statistics indicate that the manufacturing sector alone is expected to grow by 4% annually, further driving the demand for Denox services. Consequently, service providers are positioned to capitalize on this growth by offering innovative solutions tailored to the evolving needs of expanding industries.

Growing Focus on Energy Efficiency

The Industrial Denox Systems Service Market is witnessing a growing emphasis on energy efficiency among industrial players. Companies are increasingly recognizing that efficient Denox systems can lead to substantial energy savings while simultaneously reducing emissions. This dual benefit is driving investments in advanced Denox technologies that not only meet regulatory requirements but also enhance overall operational efficiency. Market analysis suggests that industries implementing energy-efficient Denox solutions can achieve up to 20% reductions in energy consumption. As a result, service providers that offer tailored solutions to optimize Denox systems are likely to see increased demand, reflecting a broader trend towards sustainable industrial practices.

Rising Awareness of Environmental Impact

There is a marked increase in awareness regarding environmental impact among consumers and businesses alike, which is shaping the Industrial Denox Systems Service Market. Stakeholders are increasingly prioritizing sustainability, leading to heightened demand for effective Denox solutions that minimize nitrogen oxide emissions. This awareness is not only driven by regulatory pressures but also by consumer preferences for environmentally responsible practices. As industries strive to enhance their corporate social responsibility profiles, the adoption of Denox systems becomes a strategic imperative. Market trends indicate that companies investing in sustainable practices are likely to experience improved brand loyalty and market competitiveness, further propelling the demand for Denox services.

Technological Innovations in Denox Systems

Technological advancements are playing a pivotal role in shaping the Industrial Denox Systems Service Market. Innovations such as enhanced catalytic converters and advanced monitoring systems are improving the efficiency and effectiveness of Denox solutions. These technologies not only facilitate compliance with environmental standards but also optimize operational costs for industries. The integration of IoT and AI in Denox systems is expected to enhance real-time monitoring and predictive maintenance, thereby reducing downtime and improving service delivery. As industries adopt these cutting-edge technologies, the demand for specialized services in the Denox sector is likely to increase, presenting significant opportunities for service providers.

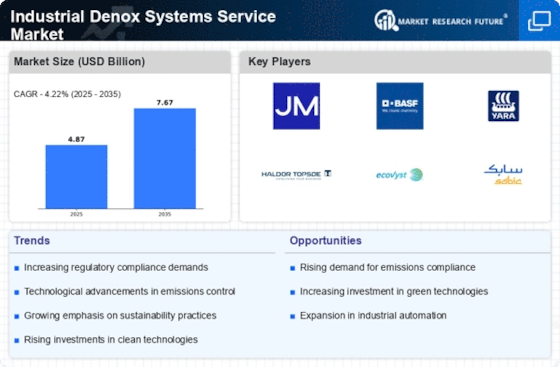

Increasing Demand for Emission Control Solutions

The Industrial Denox Systems Service Market is experiencing a notable surge in demand for emission control solutions. This trend is primarily driven by stringent environmental regulations aimed at reducing nitrogen oxide emissions from industrial processes. As industries strive to comply with these regulations, the adoption of Denox systems becomes imperative. According to recent data, the market for emission control technologies is projected to grow at a compound annual growth rate of approximately 6% over the next five years. This growth indicates a robust market potential for service providers specializing in Denox systems, as industries increasingly prioritize compliance and sustainability in their operations.