Aging Machinery Fleet

The aging machinery fleet is a significant driver of the Industrial Machinery Repair Service Market. Many industries are currently operating with older equipment that requires more frequent repairs and maintenance. As machinery ages, the likelihood of breakdowns increases, leading to unplanned downtime and costly repairs. Data suggests that a substantial portion of industrial machinery is over ten years old, which correlates with a rising demand for repair services. Companies are increasingly recognizing the importance of maintaining their existing equipment rather than investing in new machinery, as repair services can extend the life of their assets. This trend is expected to continue, thereby enhancing the growth prospects of the Industrial Machinery Repair Service Market.

Regulatory Compliance

Regulatory compliance is increasingly influencing the Industrial Machinery Repair Service Market. Governments worldwide are implementing stringent regulations regarding safety and environmental standards, compelling companies to ensure their machinery meets these requirements. Non-compliance can lead to hefty fines and operational shutdowns, prompting businesses to invest in regular maintenance and repair services. The market for compliance-related repairs is projected to grow as industries strive to adhere to these regulations. For instance, sectors such as food processing and pharmaceuticals are particularly affected, as they must maintain high standards of hygiene and safety. Thus, the emphasis on regulatory compliance is likely to bolster the demand for services within the Industrial Machinery Repair Service Market.

Technological Advancements

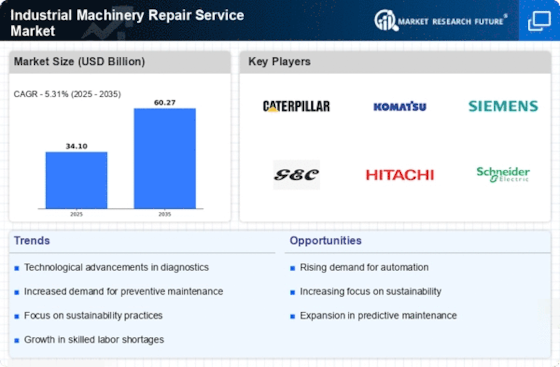

Technological advancements play a pivotal role in shaping the Industrial Machinery Repair Service Market. The integration of smart technologies, such as IoT and AI, into machinery has transformed maintenance practices. These innovations enable predictive maintenance, allowing companies to anticipate printing machinery failures before they occur. As a result, the demand for specialized repair services that can handle advanced machinery is on the rise. Data indicates that the adoption of smart technologies in manufacturing is expected to grow by over 25% in the next five years, further driving the need for skilled repair services. This evolution in technology not only enhances operational efficiency but also creates new opportunities within the Industrial Machinery Repair Service Market.

Increased Industrial Activity

The Industrial Machinery Repair Service Market is experiencing a surge in demand due to heightened industrial activity across various sectors. As manufacturing and production ramp up, the wear and tear on machinery intensifies, necessitating more frequent repairs and maintenance. According to recent data, the manufacturing sector has shown a steady growth rate of approximately 3.5% annually, which directly correlates with the increased need for repair services. This trend is particularly evident in industries such as automotive, aerospace, and construction, where machinery is critical to operations. Consequently, the Industrial Machinery Repair Service Market is poised to benefit from this uptick in industrial activity, as companies seek to minimize downtime and maintain operational efficiency.

Focus on Operational Efficiency

The focus on operational efficiency is driving growth in the Industrial Machinery Repair Service Market. Companies are continually seeking ways to optimize their operations, reduce costs, and improve productivity. Regular maintenance and timely repairs are essential components of this strategy, as they help prevent unexpected breakdowns and extend the lifespan of machinery. Recent studies indicate that businesses that prioritize maintenance can achieve up to a 20% increase in operational efficiency. As organizations strive to enhance their competitive edge, the demand for reliable repair services is likely to rise. This focus on efficiency not only benefits individual companies but also contributes to the overall growth of the Industrial Machinery Repair Service Market.