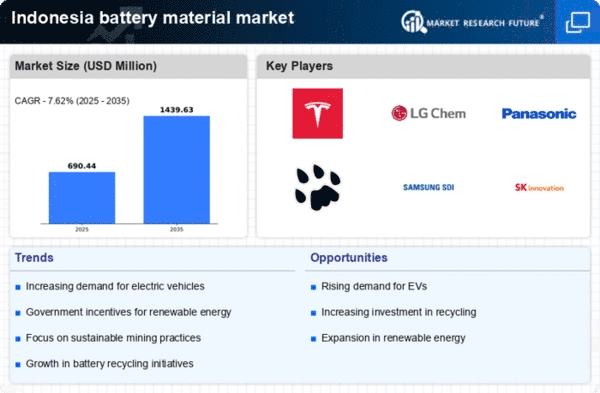

The battery material market in Indonesia is characterized by a dynamic competitive landscape, driven by increasing demand for electric vehicles (EVs) and renewable energy storage solutions. Key players such as Tesla (US), LG Chem (KR), and CATL (CN) are actively shaping the market through strategic initiatives focused on innovation and regional expansion. Tesla (US) continues to enhance its supply chain resilience by investing in local partnerships, while LG Chem (KR) emphasizes technological advancements in battery chemistry to improve energy density and sustainability. CATL (CN) is also expanding its footprint in Indonesia, indicating a collective push towards establishing a robust ecosystem for battery materials that supports the growing EV market.In terms of business tactics, companies are increasingly localizing manufacturing to mitigate supply chain disruptions and optimize logistics. The market structure appears moderately fragmented, with several players vying for market share. However, the influence of major companies is substantial, as they leverage economies of scale and advanced technologies to maintain competitive advantages. This competitive environment fosters innovation and drives improvements in battery performance and cost efficiency.

In October Tesla (US) announced a partnership with a local Indonesian mining company to secure a stable supply of nickel, a critical component in battery production. This strategic move not only enhances Tesla's supply chain reliability but also aligns with its sustainability goals by promoting responsible sourcing practices. The partnership is expected to bolster Tesla's production capabilities in the region, positioning the company favorably in the competitive landscape.

In September LG Chem (KR) unveiled plans to establish a new battery materials plant in Indonesia, aimed at increasing its production capacity by 30%. This expansion reflects LG Chem's commitment to meeting the rising demand for EV batteries and underscores its strategic focus on regional manufacturing. The new facility is anticipated to create jobs and stimulate local economies, further solidifying LG Chem's presence in the market.

In August CATL (CN) launched a new line of high-performance battery materials specifically designed for the Indonesian market. This initiative highlights CATL's adaptability and responsiveness to local market needs, as it seeks to enhance its competitive edge through tailored solutions. The introduction of these materials is likely to attract local manufacturers and strengthen CATL's market position.

As of November current trends in the battery material market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence (AI) in production processes. Strategic alliances among key players are shaping the landscape, fostering collaboration that enhances innovation and efficiency. Looking ahead, competitive differentiation is expected to evolve, with a shift from price-based competition to a focus on technological advancements, supply chain reliability, and sustainable practices. This transition may redefine market dynamics, compelling companies to innovate continuously to maintain their competitive edge.