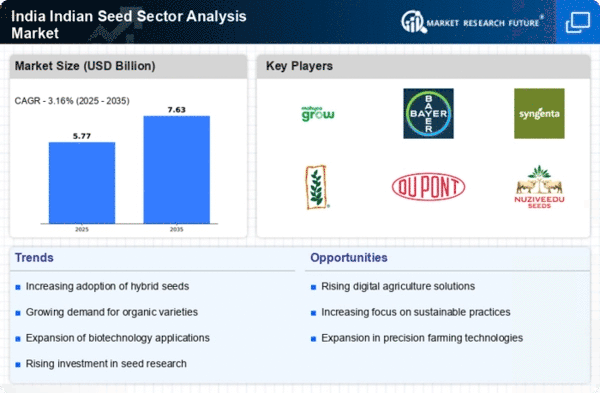

Rising Demand for High-Quality Seeds

The India Seed Sector Analysis Market is witnessing a surge in demand for high-quality seeds, driven by changing consumer preferences and the need for improved agricultural productivity. Farmers are increasingly seeking seeds that offer better yields, disease resistance, and climate adaptability. This trend is reflected in the growing market for hybrid and genetically modified seeds, which are anticipated to account for over 60% of the total seed market by 2026. As the agricultural landscape evolves, the emphasis on quality seeds is likely to shape the future of the seed sector, fostering advancements in research and development.

Investment in Research and Development

The India Seed Sector Analysis Market is bolstered by significant investments in research and development (R&D). Public and private sector entities are increasingly allocating resources to develop new seed varieties that can withstand climate change and meet the demands of a growing population. The Indian government has set aside substantial funding for agricultural research, with a focus on enhancing seed quality and productivity. This commitment to R&D is expected to yield breakthroughs in seed technology, potentially leading to the introduction of drought-resistant and high-yielding varieties. Such advancements are crucial for ensuring food security and sustainability in India's agricultural sector.

Sustainability and Organic Farming Trends

The India Seed Sector Analysis Market is adapting to the rising trends of sustainability and organic farming. With an increasing number of consumers prioritizing organic produce, there is a growing demand for organic seeds. The market for organic seeds in India is projected to grow at a CAGR of 15% over the next five years. This shift towards sustainable practices not only benefits the environment but also enhances the marketability of agricultural products. As farmers transition to organic farming, the seed industry must innovate to provide seeds that meet organic certification standards, thereby driving growth in this segment.

Government Policies and Regulatory Framework

The India Seed Sector Analysis Market is significantly influenced by government policies and regulatory frameworks aimed at promoting agricultural growth. The Indian government has implemented various initiatives, such as the National Seed Policy, which encourages research and development in seed technology. Additionally, the introduction of the Seed Bill aims to regulate seed quality and protect farmers' rights. These policies are expected to enhance the competitiveness of the seed industry, with the market projected to reach USD 10 billion by 2025. Such supportive measures create a conducive environment for investment and innovation within the seed sector.

Technological Innovations in Seed Production

The India Seed Sector Analysis Market is experiencing a transformative phase driven by technological innovations in seed production. Advanced breeding techniques, such as genetic engineering and CRISPR technology, are enhancing crop yields and resistance to pests and diseases. For instance, the introduction of hybrid seeds has led to a 20-30% increase in productivity for major crops like rice and maize. Furthermore, precision agriculture technologies are being adopted, allowing farmers to optimize inputs and maximize outputs. This technological shift not only boosts agricultural productivity but also aligns with the growing demand for food security in India, thereby propelling the seed sector forward.

.png)