Rising Disposable Income

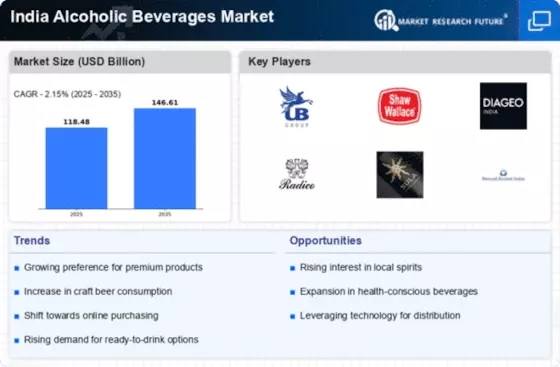

The India Alcoholic Beverages Market is experiencing growth driven by rising disposable incomes among the middle class. As economic conditions improve, consumers are increasingly willing to spend on premium and imported alcoholic beverages. According to recent data, the per capita income in India has shown a steady increase, which correlates with higher spending on luxury items, including alcoholic drinks. This trend is particularly evident in urban areas where lifestyle changes and social gatherings are becoming more common. The growing affluence of consumers is likely to lead to a greater demand for diverse alcoholic options, thereby expanding the market further.

Growing E-commerce Platforms

The rise of e-commerce platforms is transforming the India Alcoholic Beverages Market. With the increasing penetration of the internet and smartphone usage, consumers are turning to online channels for purchasing alcoholic beverages. This shift is evidenced by the growth of online liquor delivery services, which have gained popularity in urban areas. Market data suggests that online sales of alcoholic beverages are projected to grow significantly, driven by convenience and a wider selection of products. This trend is likely to encourage traditional retailers to adopt digital strategies, thereby reshaping the competitive environment in the industry.

Changing Consumer Preferences

In the India Alcoholic Beverages Market, changing consumer preferences are significantly influencing market dynamics. Younger generations are gravitating towards craft beers, artisanal spirits, and innovative cocktails, reflecting a shift from traditional alcoholic beverages. This trend is supported by the increasing popularity of social media, where unique drink experiences are shared widely. Market data indicates that craft beer sales have surged, with a notable increase in microbreweries across major cities. This evolution in consumer taste is likely to encourage manufacturers to diversify their product offerings, catering to the demand for unique and high-quality alcoholic beverages.

Government Regulations and Policies

The regulatory landscape plays a crucial role in shaping the India Alcoholic Beverages Market. Recent government policies aimed at promoting responsible drinking and regulating sales have a direct impact on market growth. For instance, states are implementing stricter licensing requirements and age restrictions, which can affect market accessibility. However, some regions are also relaxing regulations to boost tourism and local economies, allowing for a more vibrant market. The balance between regulation and market freedom is likely to influence the competitive landscape, as companies navigate these policies to optimize their operations.

Cultural Acceptance and Social Trends

Cultural acceptance of alcoholic beverages is evolving within the India Alcoholic Beverages Market. As societal norms shift, there is a growing acceptance of alcohol consumption in social settings, particularly among younger demographics. This change is reflected in the increasing number of bars, pubs, and lounges that cater to diverse consumer preferences. Additionally, festivals and celebrations are increasingly incorporating alcoholic beverages, further normalizing their consumption. Market data indicates that the demand for ready-to-drink cocktails and flavored spirits is on the rise, suggesting that cultural trends are likely to continue influencing consumer behavior in the alcoholic beverages sector.