Global Supply Chain Dynamics

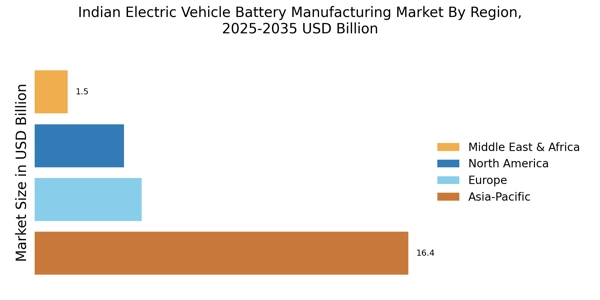

The dynamics of The Electric Vehicle Battery Manufacturing Industry. As the world shifts towards electric mobility, the demand for critical raw materials such as lithium, cobalt, and nickel is intensifying. India, recognizing the need for a stable supply chain, is exploring partnerships with countries rich in these resources. Additionally, the government is encouraging domestic mining and processing of these materials to reduce reliance on imports. This strategic approach not only aims to secure the supply chain but also positions India as a potential hub for battery manufacturing in the Asia-Pacific region. The interplay between The Electric Vehicle Battery Manufacturing Industry.

Government Initiatives and Policies

The India Electric Vehicle Battery Manufacturing Market is significantly influenced by government initiatives aimed at promoting electric mobility. The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, for instance, has allocated substantial funds to incentivize electric vehicle (EV) adoption and battery production. The government has set ambitious targets, including achieving 30 percent electric vehicle penetration by 2030. This policy framework not only encourages domestic manufacturing but also aims to reduce dependence on imports, particularly from countries like China. Furthermore, the Production-Linked Incentive (PLI) scheme is designed to boost local battery manufacturing capabilities, potentially leading to a more robust supply chain within the India Electric Vehicle Battery Manufacturing Market.

Investment in Renewable Energy Sources

Investment in renewable energy sources is emerging as a crucial driver for the India Electric Vehicle Battery Manufacturing Market. The Indian government has set a target of achieving 175 GW of renewable energy capacity by 2022, which has likely been surpassed, and aims for 450 GW by 2030. This shift towards renewable energy not only supports the sustainability of electric vehicles but also ensures that the electricity used for battery charging is derived from clean sources. As a result, the synergy between renewable energy and electric vehicle adoption is expected to bolster the demand for batteries, thereby stimulating growth in the India Electric Vehicle Battery Manufacturing Market. This alignment may also attract foreign investments, further enhancing local manufacturing capabilities.

Rising Consumer Demand for Electric Vehicles

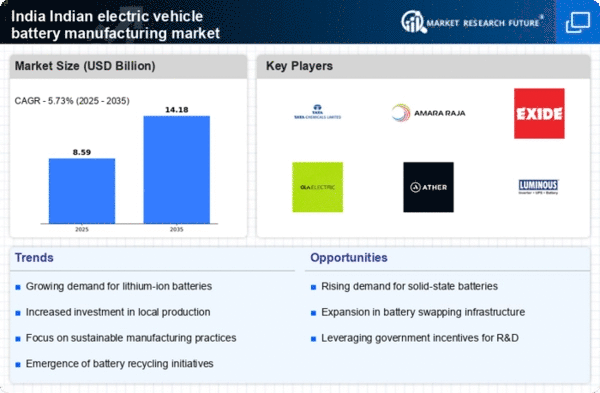

The growing consumer demand for electric vehicles is a primary driver of the India Electric Vehicle Battery Manufacturing Market. As awareness of environmental issues increases, more consumers are opting for EVs, leading to a surge in battery requirements. According to recent estimates, the demand for electric vehicles in India is projected to reach 6 million units by 2025, which will necessitate a corresponding increase in battery production capacity. This trend is further supported by the increasing availability of charging infrastructure and favorable financing options for consumers. Consequently, manufacturers are compelled to scale up production to meet this burgeoning demand, thereby enhancing the overall growth of the India Electric Vehicle Battery Manufacturing Market.

Technological Advancements in Battery Production

Technological advancements play a pivotal role in shaping the India Electric Vehicle Battery Manufacturing Market. Innovations in battery chemistry, such as the development of lithium-sulfur and solid-state batteries, are expected to enhance energy density and reduce costs. The introduction of automated manufacturing processes is also likely to improve production efficiency and scalability. As of January 2026, several Indian companies are investing in research and development to create next-generation batteries that can compete globally. The integration of artificial intelligence and machine learning in production processes may further optimize battery performance and lifecycle management, thereby positioning India as a competitive player in the global battery manufacturing landscape.