Rising Geriatric Population

The demographic shift towards an aging population in India is significantly influencing the india vitrectomy devices market. As individuals age, the incidence of age-related eye diseases, such as diabetic retinopathy and macular degeneration, tends to increase. This demographic trend is expected to lead to a higher demand for vitrectomy procedures, as older adults often require surgical interventions to preserve their vision. According to projections, the geriatric population in India is expected to reach 300 million by 2030, further amplifying the need for specialized eye care services. Consequently, the market for vitrectomy devices is likely to expand, driven by the necessity to cater to this growing segment of the population, thereby shaping the future landscape of the india vitrectomy devices market.

Growing Demand for Eye Care Services

The increasing prevalence of eye disorders in India is significantly driving the india vitrectomy devices market. With an estimated 62 million people suffering from various forms of visual impairment, the demand for specialized eye care services is on the rise. This growing patient population necessitates advanced surgical interventions, including vitrectomy procedures. Moreover, the awareness campaigns led by healthcare organizations are contributing to a heightened understanding of eye health, prompting individuals to seek timely medical attention. As a result, the market for vitrectomy devices is expected to expand, with a projected growth rate of around 7% annually. This trend underscores the urgent need for innovative solutions in the india vitrectomy devices market to address the escalating demand for effective eye care.

Government Initiatives and Healthcare Policies

Government initiatives aimed at improving healthcare infrastructure are playing a crucial role in the growth of the india vitrectomy devices market. The National Health Mission (NHM) and various state-level programs are focused on enhancing access to eye care services, particularly in rural areas. These initiatives often include funding for advanced medical equipment, including vitrectomy devices, which are essential for treating complex eye conditions. Additionally, the implementation of policies promoting public-private partnerships is likely to facilitate the introduction of cutting-edge technologies in the market. As a result, the industry is poised for growth, with an anticipated increase in the availability of vitrectomy devices across the country, thereby improving patient outcomes and expanding the market.

Technological Advancements in Vitrectomy Devices

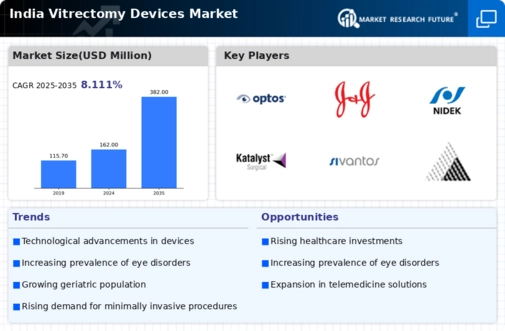

The india vitrectomy devices market is experiencing a notable transformation due to rapid technological advancements. Innovations such as high-speed vitrectomy systems and improved visualization techniques are enhancing surgical outcomes. For instance, the introduction of 25-gauge vitrectomy systems has reduced recovery times and improved patient satisfaction. Furthermore, the integration of artificial intelligence in surgical planning and execution is expected to streamline procedures, potentially increasing the efficiency of surgeries. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years, driven by these advancements. This trend indicates a shift towards more sophisticated and effective surgical solutions, which could redefine standards in the india vitrectomy devices market.

Increasing Investment in Healthcare Infrastructure

Investment in healthcare infrastructure is a pivotal driver for the india vitrectomy devices market. The government and private sector are increasingly allocating resources to enhance healthcare facilities, particularly in urban and semi-urban areas. This investment includes the procurement of advanced medical devices, such as vitrectomy systems, which are essential for performing complex eye surgeries. The establishment of specialized eye hospitals and clinics is also on the rise, further supporting the demand for vitrectomy devices. As healthcare expenditure in India is projected to reach 3.6% of GDP by 2025, the market for vitrectomy devices is expected to benefit from this trend. This influx of capital into healthcare infrastructure is likely to create a conducive environment for the growth of the india vitrectomy devices market.