Growing Awareness and Education

The US vitrectomy devices market is also benefiting from growing awareness and education regarding retinal health and surgical options. Increased public awareness campaigns and educational initiatives by healthcare organizations are informing patients about the importance of early detection and treatment of retinal disorders. This heightened awareness is leading to more patients seeking medical attention, thereby increasing the demand for vitrectomy procedures. Additionally, healthcare professionals are receiving ongoing training on the latest vitrectomy techniques and technologies, which further enhances the quality of care provided. As a result, the US vitrectomy devices market is likely to expand, driven by a more informed patient population and a well-trained healthcare workforce.

Increasing Healthcare Expenditure

The US vitrectomy devices market is positively impacted by the increasing healthcare expenditure across the nation. As healthcare spending continues to rise, hospitals and surgical centers are allocating more resources towards acquiring advanced vitrectomy devices. In 2025, healthcare expenditure in the US reached approximately $4.3 trillion, with a significant portion directed towards surgical technologies. This trend indicates a growing recognition of the importance of investing in high-quality medical devices to improve surgical outcomes and patient care. Furthermore, as reimbursement policies evolve to support innovative treatments, the US vitrectomy devices market is likely to experience sustained growth, driven by the demand for effective surgical solutions.

Regulatory Support for Innovation

The US vitrectomy devices market benefits from robust regulatory support that fosters innovation and ensures patient safety. The Food and Drug Administration (FDA) has implemented streamlined pathways for the approval of new medical devices, which encourages manufacturers to invest in research and development. This regulatory environment not only accelerates the introduction of cutting-edge vitrectomy devices but also enhances competition within the market. As a result, healthcare providers have access to a wider array of advanced surgical tools, which can lead to improved patient outcomes. The ongoing collaboration between regulatory bodies and industry stakeholders is likely to further stimulate growth in the US vitrectomy devices market, as new technologies are developed and brought to market more efficiently.

Rising Incidence of Retinal Disorders

The US vitrectomy devices market is significantly influenced by the rising incidence of retinal disorders, including diabetic retinopathy and age-related macular degeneration. The prevalence of these conditions is expected to increase as the population ages, with estimates suggesting that by 2030, nearly 30 million Americans may be affected by diabetic retinopathy alone. This growing patient population necessitates the use of advanced vitrectomy devices to manage and treat these disorders effectively. Consequently, healthcare providers are increasingly investing in state-of-the-art vitrectomy equipment to meet the rising demand for surgical interventions. The US vitrectomy devices market is thus positioned for growth, driven by the urgent need for effective treatment options for retinal diseases.

Technological Advancements in Devices

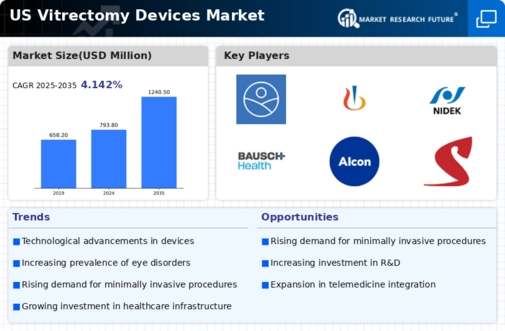

The US vitrectomy devices market is experiencing a surge in technological advancements that enhance surgical precision and patient outcomes. Innovations such as wide-angle viewing systems and improved illumination techniques are becoming increasingly prevalent. These advancements not only facilitate more effective surgeries but also reduce recovery times for patients. According to recent data, the market for advanced vitrectomy devices is projected to grow at a compound annual growth rate (CAGR) of approximately 6.5% through 2028. This growth is driven by the increasing adoption of minimally invasive surgical techniques, which are favored by both surgeons and patients. As technology continues to evolve, the US vitrectomy devices market is likely to witness further enhancements that could redefine surgical standards.