Increasing Security Concerns

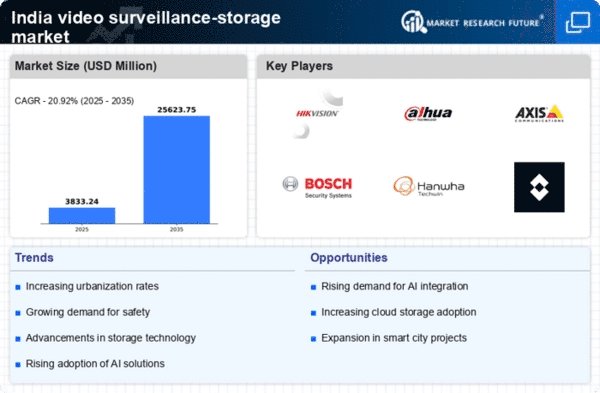

The escalating concerns regarding security in urban and rural areas are driving the demand for the video surveillance-storage market. With rising crime rates and the need for enhanced safety measures, organizations and individuals are increasingly investing in surveillance systems. In India, the market for video surveillance is projected to grow at a CAGR of approximately 20% from 2023 to 2028. This growth is indicative of a broader trend where both public and private sectors are prioritizing security investments. Thus, the video surveillance-storage market is positioned to benefit from this heightened focus on safety. More entities are seeking reliable storage solutions for their surveillance footage.

Government Initiatives and Regulations

Government initiatives aimed at improving public safety and security are significantly influencing the video surveillance-storage market. Various state and central government programs are promoting the installation of surveillance systems in public spaces, which necessitates robust storage solutions. For instance, the Smart Cities Mission in India emphasizes the integration of technology in urban planning, including surveillance systems. This initiative is expected to bolster the video surveillance-storage market, as it creates a demand for efficient data management and storage solutions. Furthermore, compliance with regulations regarding data retention and privacy is likely to drive investments in secure storage options.

Rising Adoption of Smart City Projects

The ongoing development of smart city projects across India is a crucial driver for the video surveillance-storage market. These projects often incorporate extensive surveillance systems to monitor urban environments, thereby necessitating efficient storage solutions for the vast amounts of data generated. As cities evolve into smart ecosystems, the demand for integrated surveillance and storage solutions is expected to rise. The video surveillance-storage market stands to gain from this trend, as municipalities and private developers invest in infrastructure that supports advanced surveillance capabilities. This shift towards smart city initiatives is likely to create a sustained demand for innovative storage solutions.

Technological Advancements in Storage Solutions

The rapid advancements in storage technologies are reshaping the video surveillance-storage market. Innovations such as high-capacity hard drives, solid-state drives (SSDs), and cloud storage options are enhancing the efficiency and reliability of data storage. In India, the adoption of these technologies is expected to increase as organizations seek to optimize their surveillance systems. The integration of advanced storage solutions allows for longer retention periods and improved data retrieval processes. As a result, the video surveillance-storage market is likely to experience growth driven by the demand for cutting-edge storage technologies that can accommodate the increasing volume of surveillance data.

Growing Demand from Retail and Commercial Sectors

The retail and commercial sectors in India are increasingly recognizing the value of video surveillance systems for loss prevention and operational efficiency. As businesses seek to protect their assets and enhance customer experiences, the demand for video surveillance-storage solutions is on the rise. Retailers are investing in sophisticated surveillance systems that require reliable storage for video data. The video surveillance-storage market is expected to benefit from this trend, as businesses prioritize security measures to mitigate risks. With the retail sector projected to grow significantly, the demand for effective storage solutions for surveillance footage is likely to follow suit.