Regulatory Framework Enhancements

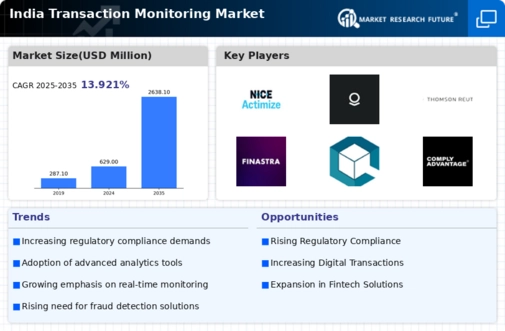

The evolving regulatory landscape in India is significantly influencing the transaction monitoring market. Recent enhancements in regulations aimed at combating financial crimes have compelled financial institutions to adopt more sophisticated monitoring solutions. The Reserve Bank of India (RBI) has introduced stringent guidelines that require banks to implement effective transaction monitoring systems. As a result, the transaction monitoring market is projected to grow at a CAGR of approximately 12% over the next few years. This regulatory pressure is driving investments in technology and infrastructure, as institutions strive to comply with the new standards. Consequently, the transaction monitoring market is becoming increasingly vital for financial institutions to maintain compliance and avoid penalties.

Increasing Financial Crime Threats

The transaction monitoring market in India is experiencing heightened demand due to the increasing threats posed by financial crimes such as money laundering and fraud. As financial institutions face mounting pressure to detect and prevent these illicit activities, The transaction monitoring market is projected to grow significantly. According to recent estimates, it is expected to reach approximately $1.5 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 15%. This growth is driven by the need for advanced monitoring solutions that can effectively identify suspicious transactions and mitigate risks associated with financial crimes. Consequently, the transaction monitoring market is becoming an essential component of financial institutions' compliance strategies, ensuring they adhere to regulatory requirements while safeguarding their operations.

Adoption of Digital Payment Systems

The rapid adoption of digital payment systems in India is a key driver for the transaction monitoring market. With the increasing use of mobile wallets, online banking, and e-commerce platforms, the volume of transactions has surged. This shift necessitates robust transaction monitoring solutions to ensure the security and integrity of financial transactions. As per industry reports, digital payment transactions in India are expected to exceed 7 billion by 2025, creating a substantial need for effective monitoring systems. Financial institutions are investing in advanced technologies to enhance their transaction monitoring capabilities, thereby fostering growth in the transaction monitoring market. This trend indicates a growing recognition of the importance of safeguarding digital transactions against potential fraud and financial crimes.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into transaction monitoring systems is transforming the landscape of the transaction monitoring market in India. AI technologies enable financial institutions to analyze vast amounts of transaction data in real-time, enhancing their ability to detect anomalies and potential fraud. This technological advancement is expected to drive market growth, as institutions seek to leverage AI for more efficient monitoring processes. Reports suggest that AI-driven solutions could reduce false positives by up to 70%, significantly improving operational efficiency. As a result, the transaction monitoring market is likely to witness increased adoption of AI technologies, positioning institutions to better combat financial crimes and enhance their compliance efforts.

Growing Awareness of Cybersecurity Risks

The growing awareness of cybersecurity risks among financial institutions is a crucial driver for the transaction monitoring market in India. As cyber threats become more sophisticated, institutions are recognizing the need for comprehensive monitoring solutions to protect sensitive financial data. This heightened awareness is prompting investments in advanced transaction monitoring systems that can effectively identify and mitigate cybersecurity threats. According to industry forecasts, the transaction monitoring market is anticipated to grow by approximately 10% annually as institutions prioritize cybersecurity measures. This trend underscores the importance of integrating robust monitoring solutions into overall risk management strategies, ensuring that financial institutions can safeguard their operations against emerging cyber threats.